SaaS決済

SaaS決済承認率とは?

SaaS決済承認率とは?

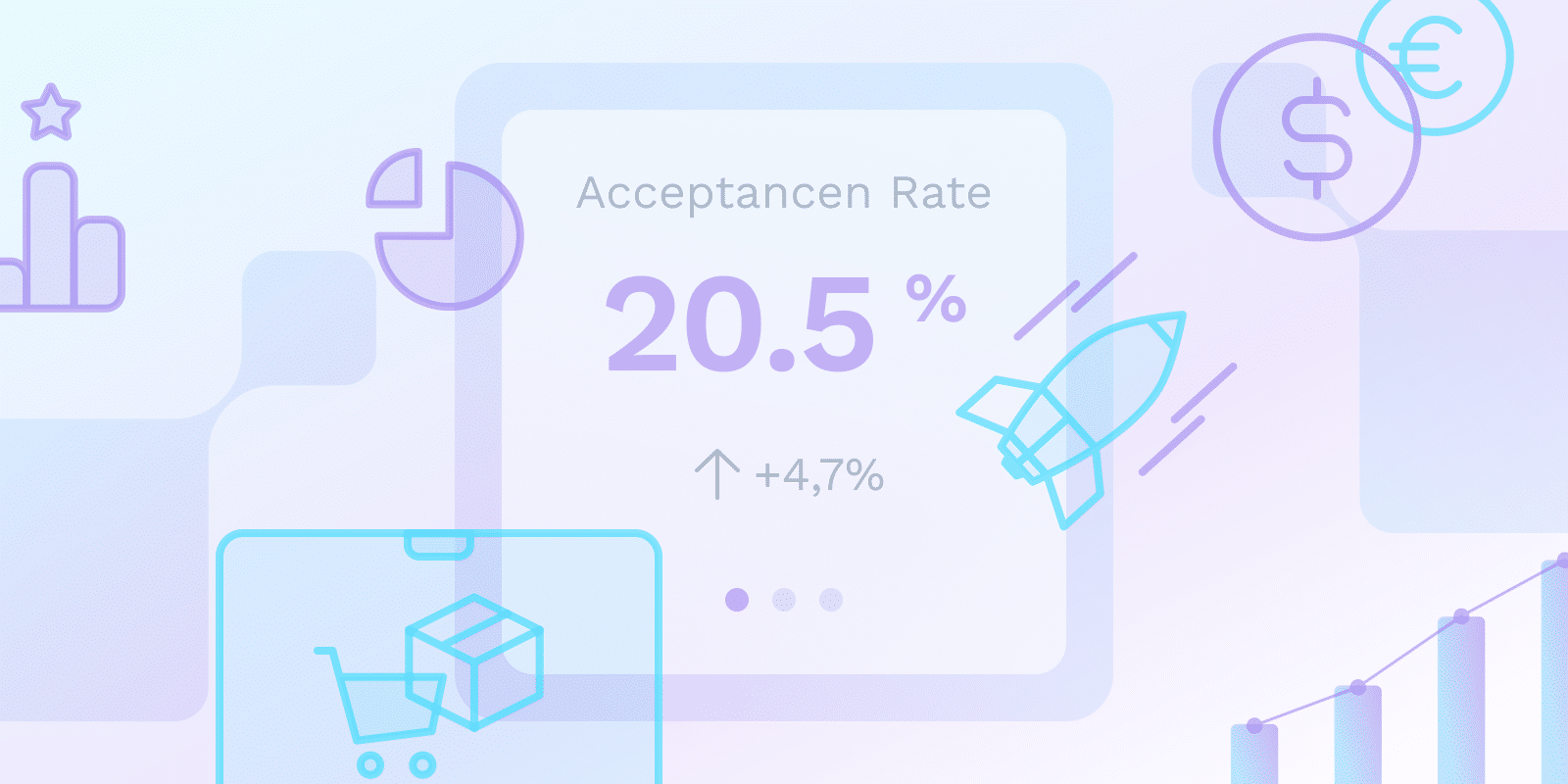

SaaS決済承認率とは、顧客による支払いが成功した割合を、支払試行の総数と比較したものです。

高い回収率は収益損失と関連する回収費用を削減するため、業務効率にとって不可欠です。支払いの承認率の向上は、多くの場合、障害やサービスの問題を減らし、顧客満足度を高めることにつながります。

PayPalと銀行振込は異なるベンチマークを持つ場合がありますが、クレジットカードの承認率としても知られる決済承認率は、通常85%から95%の間です。さらに、承認率は、発行者による取引試行の正当性を測る指標となります。

SaaS決済承認率の追跡が重要な理由

SaaS決済承認率の監視は、決済処理システムの有効性を評価するために不可欠です。

定期的な追跡により、以下が可能になります。

- 取引エラーの迅速な特定と解決

- キャッシュフローの信頼性向上

- 手動チェックの必要性削減

承認率がビジネスに与える影響:

|

A 高い承認率 次のことを示します。 |

A 低い承認率 次のことを示唆している可能性があります。 |

|

スムーズで効率的な取引処理 |

支払いプロセスにおける根本的な問題 |

|

ポジティブな顧客体験 |

顧客の損失の可能性 |

|

事業の成功 |

収益と売上の減少 |

顧客の信頼を維持し、機密性の高い財務情報を保護するために、支払い処理時のセキュリティを優先することが不可欠です。

SaaS決済の失敗の主な原因は何ですか?

SaaS決済失敗の主な原因 以下を含む:

- カードインフラの問題

- 資金不足

- キャンセルまたは期限切れのクレジットカード

- 時折発生するシステムエラー

これらの問題はしばしば以下の原因となる 非自発的解約.

SaaSの支払い失敗の種類は何ですか?

SaaSの決済失敗には2種類あり、それぞれに独自の原因があります。

- ソフトデクライン:発行銀行によって支払いが承認されたが、トランザクションが別の段階で失敗した場合。これらは一時的な問題であり、支払いの再試行によって頻繁に修正されます。

- ハードデクライン: 取引が発行銀行によって完全に拒否された場合。主な失敗原因に対処しない限り、支払いの再試行では問題は解決しません。

支払い失敗の原因

|

ソフトデクライン |

ハードデクライン |

|

資金不足 |

無効なアカウント/カード情報 |

|

カードの利用限度額を超過しました |

不正検出/不正の疑い |

|

ネットワーク接続の問題 |

閉鎖/凍結されたアカウント |

|

認証要件 |

盗難または紛失したカード |

|

一時的なシステム停止 |

地理的制限 |

|

ベロシティチェック(取引が多すぎる) |

ブロックされた加盟店 |

|

リスク管理トリガー |

ご利用いただけないカードの種類 |

SaaS企業はどのようにして支払い承認率を効果的に向上させることができますか?

SaaS企業が決済承認率の変化を体験する方法は次のとおりです。

- 顧客の地域に合わせたローカライズされた支払いオプションを提供する

- 信頼性と互換性のために銀行インフラストラクチャを最適化する

- 堅牢な(システムを)使用する サブスクリプション管理システム より良い請求管理のために

これは顧客満足度と相関関係がある可能性があります 非自発的解約 率、および収益創出に影響する可能性があります。

長期的な成功のためには、摩擦のない支払い体験を優先し、決済技術の最新情報を入手し続けることが重要です。

さまざまな支払い方法は、SaaSの支払い承認率にどのように影響しますか?

顧客によって好みが異なるため、さまざまな 支払い方法(デジタルウォレット、クレジットカード、デビットカード、モバイル決済など)を提供することは、取引完了率に影響を与える可能性があります。

承認率が大きく変動する可能性があるため、 通貨 および決済方法のローカライズは、 国際取引において不可欠です。

承認率を最大化するために、SaaSビジネスは失敗した取引を監視し、変化する消費者の嗜好と新しい決済オプションに合わせて決済承認手順を変更する必要があります。

支払いプロバイダーの選択は、私のSaaSビジネスの支払い承認率にどのような影響を与えますか?

アクワイアリングバンクとの関係があるため、 決済処理業者、および彼らが受け入れる支払い方法により、選択した決済プロバイダーはSaaSの決済承認率に大きな影響を与えます。

PayPro Globalのような経験豊富なパートナーと連携することで、承認率やダウンタイムへの影響など、トランザクション処理の結果が向上する可能性があります。

結論

今日のサブスクリプション主導型経済において、SaaS決済の承認率の最適化は必須事項であり、戦略的です。決済トレンドを追跡し、拒否率を削減し、顧客の好みに適応する企業は、解約率を削減し、収益を向上させ、グローバル市場で競争力を高めることができます。