What is Burn Rate?

SaaS-statistieken en -KPI's

What is the burn rate?

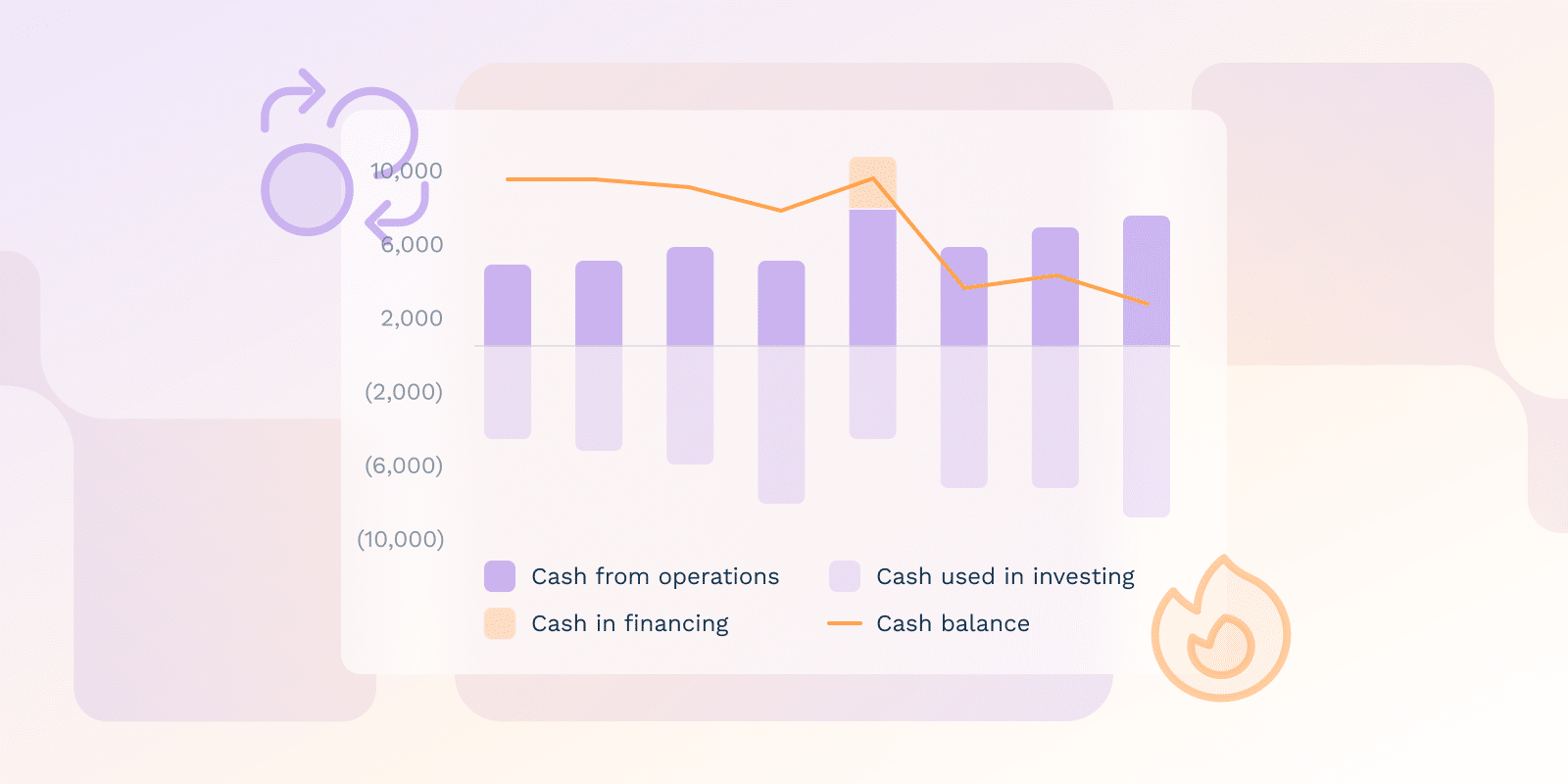

Burn rate is how quickly an organization manages its finances before reaching the break-even point or operating at a profit. This metric is especially true for start-ups and new businesses that are not yet earning or breaking even with the costs spread.

Knowing how long your business’s cash reserves will last is essential in properly forecasting cash requirements. The burn rate often reveals insights into a company’s financial health. While a high burn rate may suggest potential financial risk, a low rate might indicate limited growth.

How is the burn rate calculated?

In calculating the burn rate, establish the starting and ending cash balances for a time period, such as a month.

Second, take the cash balance as of the last day of the period, deduct it from the cash balance on the first day of the period, and divide the number of months in the period.

Consider the case in which a company has to begin a month with $100,000 and finish it with $80,000. The monthly burn rate is thus 20,000, which is ($100,000 – $80,000) / 1 month = 20,000.

Remember that there are two sorts of burn rates. The gross burn rate includes all the operating expenses for a given period, while the net burn rate comes after deducting all operating costs.

What key factors affect a business's burn rate?

Burn rate is a period or rate at which an organization expends its reserves, usually measured in months or weeks, depending on the rate of expenditures. Consider the following factors:

- When expanding, a business controls the burn rate by considering company size, growth rate, expenditures, revenue sourcing, cash inflow, and other external factors.

- Consider revenue generation since it determines how fast the resources of a company can be replenished.

- General administrative expenses and other implications of funding, like making loan repayments, have a considerable impact on computations concerning the overall burn rate and should not be overlooked.

- Managing over-expenditure is essential to achieve long-term prudent sustainability, reducing potential negative impacts on business progress.

What is the importance of the burn rate to investors and stakeholders?

Monitoring the burn rate provides stakeholders with valuable insights into the financial health of the organization, particularly the amount of cash resources available.

By understanding the amount of risk attached when investing in the business, as well as the rate of expenditure on cash availability, the burn rate helps determine what resources are available to support the business.

With this metric, it’s determined how long an organization can remain operational and reach break-even without earning a profit or receiving more funding.

What is a good burn rate?

Calculating the burn rate includes identifying negative growth and the rate of loss. An ideal burn rate reveals how fast an organization depletes its cash resources without going out of business.

In the case of SaaS companies, a healthy burn rate is typically when a company can still acquire customers while having a stable cash inflow from subscribers. A negative net burn rate, indicating a company’s positive cash flow, is a financial gauge that investors may consider when evaluating its financieel beheer. and capacity.

To ensure sound financial management, management should adopt a cautious approach to cash utilization and avoid unnecessary fundraising.

How can businesses spend their burn rate productively?

Track the costs incurred by the organization and account for financial activities regularly. Scrutinize expenditures to determine what should be cut down or improved upon. Find ways to increase income, such as performing account receivables finance, spending less than the firm’s operating budget, and discontinuing low profitability branches of the company.

Operational planning and forecasting approaches might aid in the simplification of burn rate management, although results may vary.

Conclusie

Measuring your burn rate will identify insight into a company’s financial health and risk. Since it measures how fast the business uses its cash reserves, it’s important for planning. Consider company size, expenses, revenue, and growth rate when looking at this metric. Managing your burn rate is not a guarantee for success, but it does show potential for longevity and expansion.