financieel beheer.

What is Order to Cash (OTC) for SaaS Recurring Revenue?

What is Order to Cash (OTC) for SaaS Recurring Revenue?

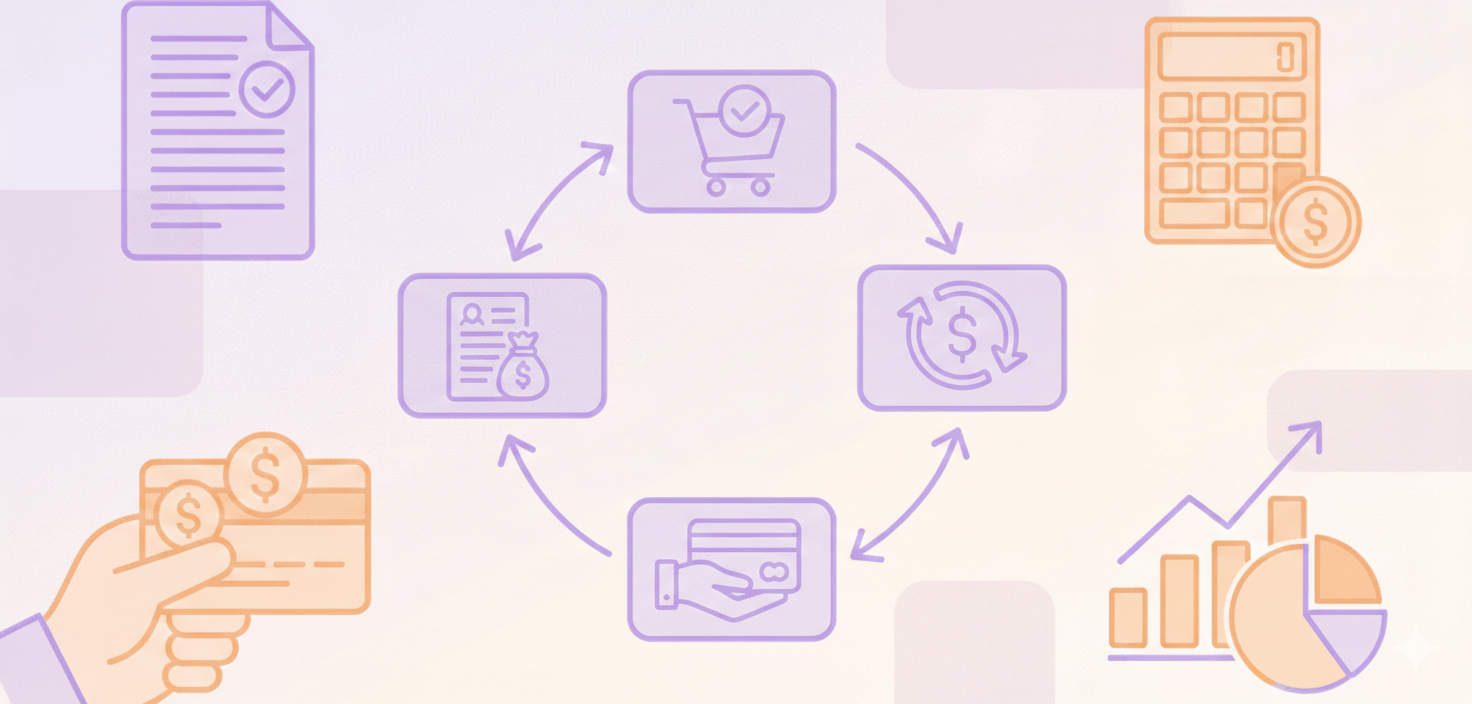

Order to Cash (OTC) for SaaS Recurring Revenue is an end-to-end business cycle covering activities from receiving customer orders to collecting payment and reconciling revenue.

It is important for SaaS companies to have such a process, as managing subscriptions, renewals, and usage-based billing is complex for recurring revenue.

The accuracy of billing and entitlement management within the OTC process is related to consistent monthly and annual recurring revenue.

If the OTC process is not efficient, it can reduce cash flow, revenue recognition, customer satisfaction, net revenue retention, and average revenue per user (ARPU).

How does the Order-to-Cash (OTC) process work in SaaS?

- The OTC process in SaaS starts when a SaaS company receives an order from a customer.

- Once that happens, the customer’s credit is verified to establish payment reliability.

- The order is completed, and the user receives access to product features.

- The revenue is recognized, and data is secured.

Voorbeeld:

A customer subscribing to a SaaS platform will have their payment information verified, their account activated with the agreed-upon features, and then be billed on a recurring cycle.

SaaS businesses should consider integrating CRM systems with billing platforms. Also, workflows should be automated to avoid handling data manually.

Why is optimizing Order to Cash (OTC) so important for SaaS businesses?

SaaS companies should optimize Order to Cash processes for the following reasons:

- it affects cash flow, which is a key factor in the financial health and stability of the company.

- effective OTC reduces manual effort and reduces the risk of error, which is crucial for operational efficiency.

- Advanced OTC optimization, potentially utilizing artificial intelligence and machine learning, may have an association with demand forecasting, cash flow trend prediction, and receivables management. This may have an impact on both time allocation and cash flow management practices.

Continuous optimization of OTC should be done side by side with SaaS spend optimization, which includes cost reduction and contract maximization.

How can my SaaS business improve its OTC process?

To improve the OTC process, you need to follow these steps:

- Start by optimizing cash flow and accounts receivable management.

- Standardize data and workflows across your CRM, billing, and ERP systems to avoid bottlenecks.

- Continuously analyze system metrics and KPIs to refine and optimize your OTC processes regularly.

- Consider implementing a dedicated platform like PayPro Global to simplify the entire OTC process without relying on multiple point solutions.

- Leverage APIs or enterprise connectors to achieve end-to-end automation, reduce manual tasks, and improve customer experiences.

What are the pros and cons of OTC handling multiple currencies in SaaS?

OTC process for SaaS has both pros and cons:

|

Voordelen |

Nadelen |

|

Localized pricing improves customer experience. |

OTC involved financial, technical, and regulatory complexities in the back-end system. |

|

Simplified transactions for international customers via SaaS payment systems. |

The impact of preferred payment methods and transaction costs varies across markets. |

|

It represents an advantage for global expansion. |

It involves complex management of VAT regulations and import/export duties across regions. |

How does Order to Cash (OTC) relate to Quote to Cash (QTC) in SaaS?

In SaaS, the Order to Cash process is a part of the larger Quote to Cash process. The QTC process includes all activities from generating customer interest in the product or service to the recognition of the related revenue.

These factors can influence the speed and ease of verlengingen and have an effect on sales processes.

Combining OTC and QTC functions could relate to changes in cash flow managementf and verkoopproces efficiency.

Locating the right ERP system is a prerequisite to tracking all the activities related to the QTC process and making continuous improvements.

How can OTC help prevent revenue leakage in SaaS?

OTC prevents revenue leakage in SaaS by automating billing, ensuring accurate charge capture, and integrating contracts with billing systems.

Dit leidt tot:

- fewer missed payments

- nauwkeurige facturatie

- maximized revenue capture through real-time usage tracking

- enforcement of entitlements.

Cross-functional accountability, CRM/ERP integration, and continuous KPI monitoring help in identifying and removing sources of revenue leakage which may be due to irregularities in the recorded revenue and the expected revenue.

Conclusie

The Order to Cash process is a critical one for SaaS companies with recurring revenue, as it encompasses various activities from the time a customer places an order with the company to the point where the company has received the money for the sale.

This process needs to be optimized carefully for efficiency as it directly affects cash flow, the accuracy of invoicing, and customer satisfaction.

One way to enhance this process is to view it as part of a larger Quote-to-Cash cycle and focus on preventing revenue leakage. With these measures in place, SaaS companies will increase their financial safety and enjoy a sustainable growth model.