Métricas e KPIs de SaaS

O que é a taxa de Churn SaaS?

O que é a taxa de churn SaaS?

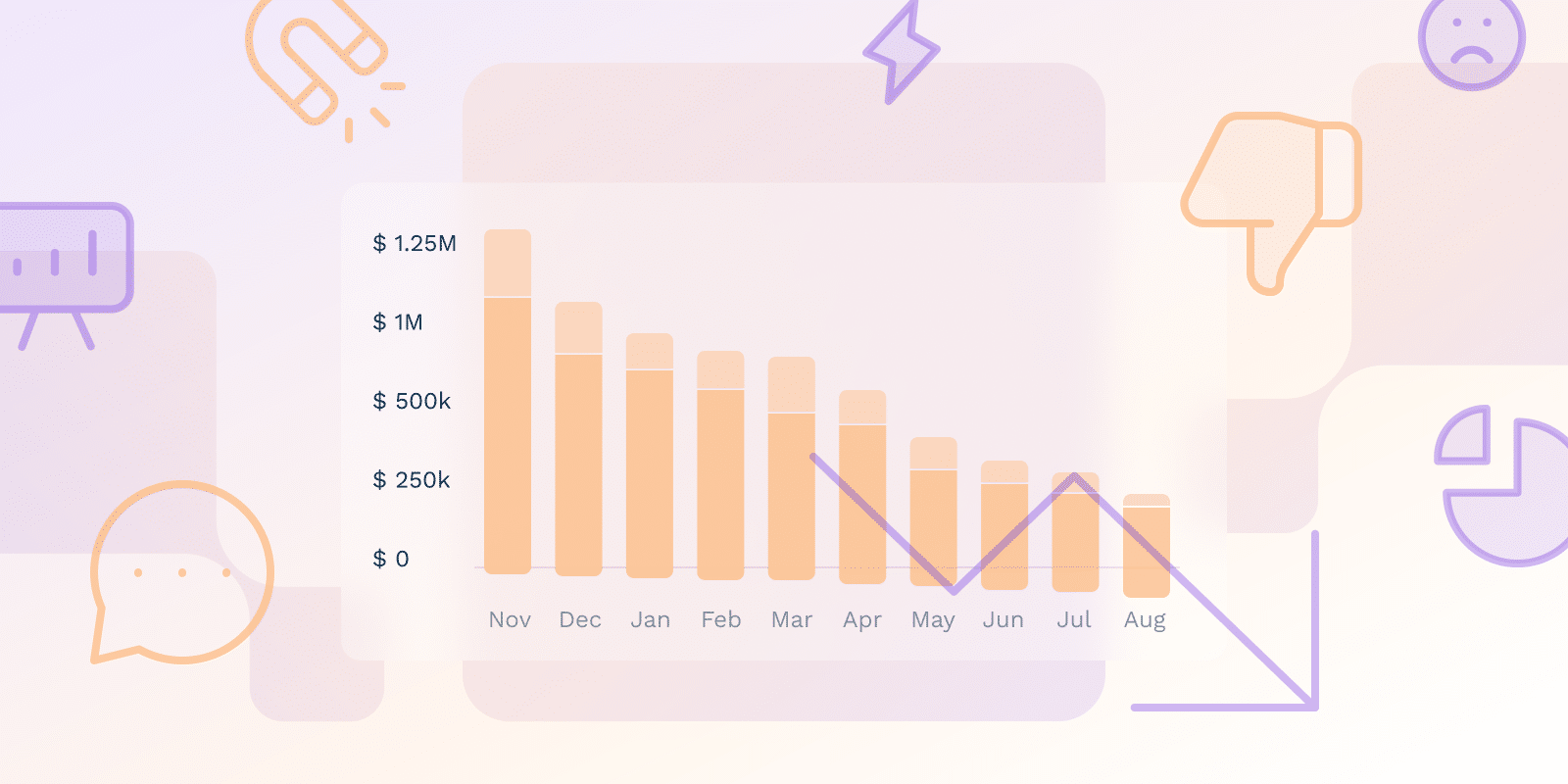

A taxa na qual os usuários deixam de pagar ou utilizar um produto SaaS dentro de um período específico é conhecida como churn de SaaS. É um indicador crucial, pois mostra a perda de clientes, o que afeta o valor vitalício, a retenção e, eventualmente, a lucratividade. A taxa de churn é essencial para antecipar a receita e determinar a probabilidade de cancelamento do cliente. O churn tem um impacto direto nas principais métricas de desempenho, incluindo crescimento, ARR, MRR e taxas de renovação, e está fortemente correlacionado com a satisfação do cliente para empresas SaaS bem estabelecidas.

Por que a rotatividade é a métrica mais importante para empresas de SaaS?

Como mostra quantos usuários estão abandonando seu produto SaaS, o que tem um efeito direto em sua receita e crescimento, a taxa de churn é a métrica mais crucial. Mudanças nos níveis de retenção de clientes podem afetar as oportunidades de expandir a clientela e aumentar as vendas. Você pode determinar os motivos por trás da insatisfação do cliente e fazer os ajustes necessários para mantê-los, monitorando atentamente sua taxa de churn. Uma alta taxa de churn tem o potencial de impactar a viabilidade a longo prazo e a estabilidade financeira do seu negócio SaaS; ações oportunas para gerenciá-la são cruciais para garantir seu sucesso futuro.

Como você calcula a taxa de rotatividade?

Para calcular sua taxa de churn de SaaS, use a seguinte fórmula:

Taxa de Churn de SaaS = Número de Clientes PerdidosNúmero de clientes no início do período x 100

Por exemplo, se você começou o mês com 1.000 clientes e perdeu 50 durante o mês, sua taxa de rotatividade seria de 5% (50 / 1.000 = 0,05 * 100 = 5%).

Como o churn de clientes difere do churn de receita?

Churn de receita e churn de clientes representam duas métricas principais que medem o impacto financeiro das perdas de clientes e a taxa na qual os clientes descontinuam seus serviços, respectivamente. Uma avaliação mais precisa do efeito na saúde financeira de uma empresa é possibilitada pelo churn de receita, que considera a receita produzida por cada cliente.

Monitorar ambos os indicadores oferece uma compreensão mais completa de como o churn afeta a empresa. Embora a rotatividade de clientes forneça alguma visão sobre os efeitos financeiros, ela não captura totalmente o impacto, especialmente ao considerar membros premium.

Quais são as principais razões por trás da rotatividade de clientes?

Várias coisas podem levar à perda de clientes, incluindo:

- preços inconsistentes

- falhas no produto

- pressão da concorrência

- mudanças operacionais em toda a empresa

- baixo valor percebido

- atendimento ao cliente abaixo da média

- acesso limitado à liderança.

As empresas podem reduzir a rotatividade implementando políticas como preços competitivos, melhor qualidade do produto, melhor atendimento ao cliente e linhas de contato abertas com executivos. Para personalizar as soluções adequadamente, é essencial identificar as causas precisas da perda de clientes.

Por que algumas empresas têm dificuldades em priorizar a redução da rotatividade de clientes?

Embora a redução da rotatividade seja um objetivo de negócios crucial, alguns fatores podem dificultar a priorização. Esses incluem:

- consciência limitada do impacto financeiro da rotatividade

- dados inadequados para identificar clientes em risco

- recursos limitados de suporte ao cliente

- processos de integração que não criam uma experiência do usuário perfeita e positiva.

Empresas que lidam com sucesso com essas áreas podem aumentar a fidelidade do cliente, construir a reputação da marca e reter clientes enquanto criam novas perspectivas de negócios. Negligenciar a redução do churn pode ter efeitos negativos, como a diminuição do lifetime value do cliente, perda de receita e crescimento lento. Negligenciar a redução do churn pode ter efeitos negativos, como a diminuição do lifetime value do cliente, perda de receita e crescimento lento.

Quais são os diferentes tipos de rotatividade?

O churn pode ser amplamente categorizado em vários tipos, incluindo churn voluntário, churn involuntário, churn de clientes, churn de receita, churn de produto, churn de downgrade, churn de upgrade e churn sazonal.

As empresas, especialmente as organizações SaaS, devem compreender essas várias formas de churn para personalizar adequadamente suas táticas de retenção e lidar com os motivos subjacentes à perda de clientes.

As empresas podem tomar medidas focadas para aumentar Retenção de Clientes e garantir a estabilidade da receita, determinando as formas precisas de churn que estão impactando suas operações. Ignorar o churn pode impedir o crescimento dos negócios e resultar em grandes perdas financeiras. O sucesso a longo prazo, portanto, depende do gerenciamento proativo do churn por meio de táticas eficientes de retenção.

| Tipo de Churn | Definição | Características Principais |

|---|---|---|

| Intenção do Cliente | ||

| Rotatividade Voluntária | Clientes optam ativamente por descontinuar o serviço | Impulsionado por insatisfação, alternativas melhores |

| Rotatividade Involuntária | Clientes param de usar o serviço involuntariamente | Causado por falhas de pagamento, cartões expirados |

| Perspectiva de Mensuração | ||

| Rotatividade de Clientes | Número de clientes perdidos | Indica a taxa de retenção de clientes |

| Rotatividade de Receita | Impacto financeiro da perda de clientes | Considera a receita por cliente |

| Dinâmica de Produto e Preços | ||

| Churn de Produto | Clientes alternando entre níveis de produto | Reflete a satisfação com os recursos do produto |

| Churn de Downgrade | Clientes migrando para níveis de preço mais baixos | Indica valor percebido reduzido |

| Churn de Upgrade | Clientes migrando para níveis de preço mais altos | Sinaliza experiência positiva com o produto |

| Churn Sazonal | Flutuações na base de clientes devido a fatores sazonais | Varia de acordo com o setor e o modelo de negócios |

Como você pode identificar clientes em risco de rotatividade?

As empresas podem identificar clientes que provavelmente deixarão de usar seus serviços usando estratégias orientadas por dados. Essas táticas incluem:

- plataformas de inteligência de conversação, que examinam as conversas dos clientes para encontrar indicadores de risco de churn

- análise preditiva, que avalia padrões nos dados do cliente para prever a probabilidade de churn

- análise de coorte, que auxilia no rastreamento da atividade do cliente em grupos específicos

- monitoramento de mudanças no nível da empresa, como fusões ou aquisições, que podem afetar o comportamento do cliente.

Para identificar clientes em risco precocemente, é crucial coletar insights de múltiplas fontes. A detecção precoce desses clientes permite que as empresas resolvam seus problemas e possivelmente recuperem seus negócios de forma proativa. É crucial lembrar que essas estratégias devem ser personalizadas para o modelo de negócios e setor específicos.

Conclusão

Um indicador crucial para empresas SaaS é a taxa de churn, que mostra a frequência com que os clientes interrompem o uso ou o pagamento de seus serviços. As empresas podem identificar consumidores em risco e planejar o aumento da retenção de clientes e a redução do churn conhecendo as várias formas de churn e suas principais causas. Para o sucesso a longo prazo, a redução do churn deve ser priorizada; caso contrário, pode resultar em perda de receita, declínio no valor vitalício do cliente e crescimento lento. As empresas podem garantir a fidelidade do cliente, melhorar sua reputação como marca e aproveitar novas perspectivas de crescimento gerenciando o churn de forma proativa.