财务管理

什么是 SaaS 财务建模?

SaaS 中的财务建模是什么?

在 SaaS(软件即服务)领域,财务建模指的是构建组织财务业绩的不同展示方式。这可以通过使用专门的软件来实现,或者以传统方式通过电子表格来实现。

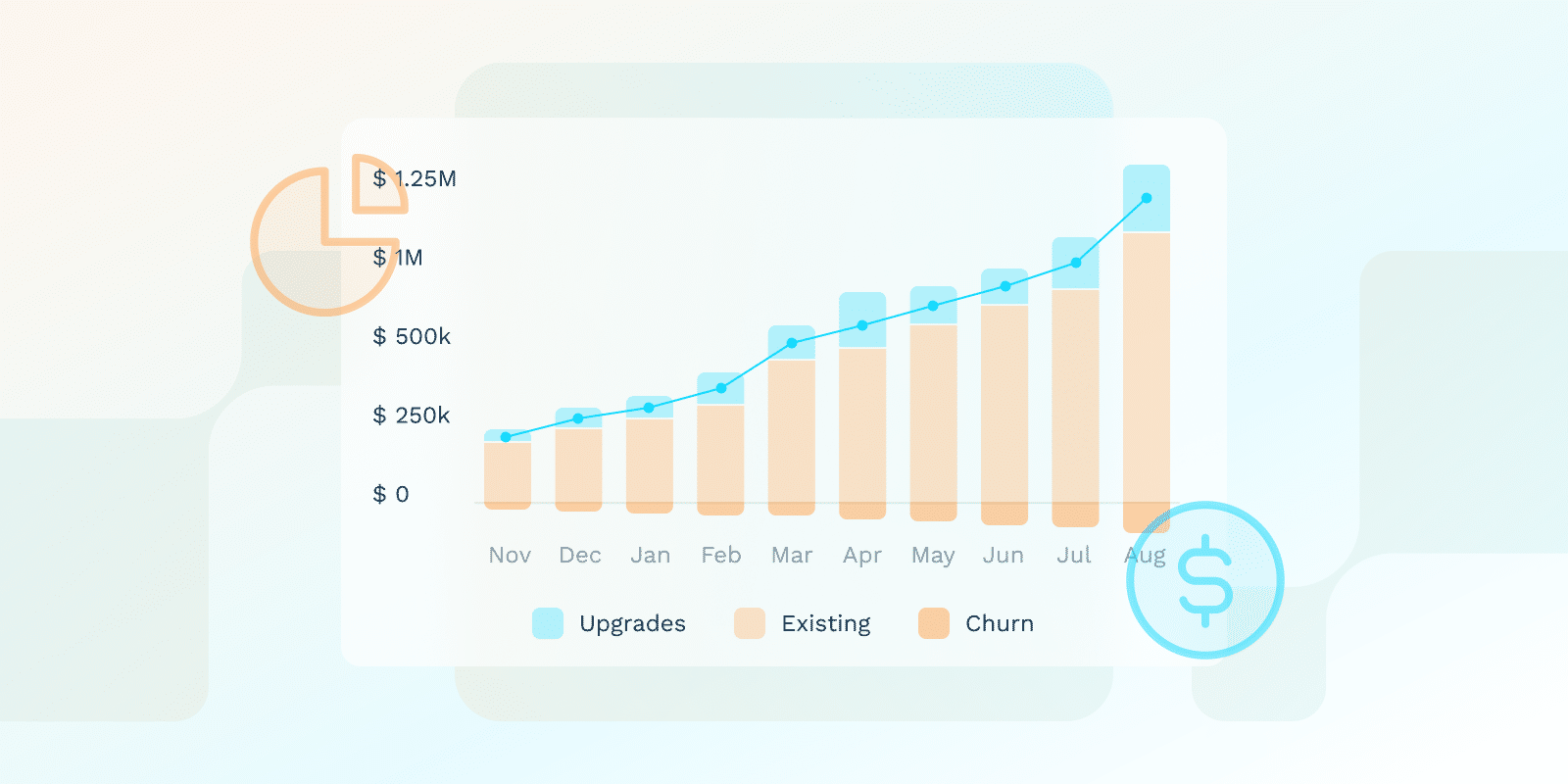

财务建模会关注特定的 SaaS 指标,例如 每月经常性收入 (MRR)、客户流失率、客户获取成本 (CAC) 和客户生命周期价值 (LTV) 来预测收入。

对于 SaaS 创始人来说,这种方法是确定未来财务结果并根据真实数据或见解做出业务决策的关键。

您如何预测SaaS业务的收入?

考虑到 SaaS 产品的首选商业模式是订阅定价策略,收入预测围绕着经常性收入的概念展开。以下是该流程中的一些关键要素:

- 用户获取:尝试估算您的 SaaS 产品在特定时间范围内将获得多少客户。

- 客户流失率:估算在同一时间段内有多少用户将取消订阅。

- 扩展:考虑通过升级、追加销售、交叉销售或附加组件获得的潜在收入。

- 收缩:评估降级可能造成的收入损失。

所有这些要点结合起来可以帮助SaaS企业预测收入,并优化定价和预算分配。

在财务模型中,有哪些关键的SaaS指标需要跟踪?

当使用财务模型跟踪收入时,SaaS组织应监控以下几个方面 SaaS 指标.

每月经常性收入(MRR)是一个可靠的基准,用于衡量SaaS公司每月产生的收入。

另一个需要监控的指标是客户流失率,它表示取消订阅的用户数量。这与客户保留率直接相关,百分比越高,保留率就越低。

接下来,SaaS 企业需要了解通过以下方式获取新客户的成本是多少 客户获取 客户获取成本 (CAC)。另一方面,分析客户生命周期价值 (LTV) 通过评估客户的预期总收入来显示用户关系的盈利能力。

消耗率是一个 SaaS 指标,应定期跟踪以确定组织消耗现金的速度。这是一个与初创企业相关的指标。

| 指标 | 定义 | 重要性 |

|---|---|---|

| 收入指标 | ||

| 月度经常性收入 (MRR) | 每月从订阅中产生的总可预测收入 | 提供稳定的收入基准并帮助预测财务业绩 |

| 客户绩效指标 | ||

| 客户流失率 | 在给定期间内取消订阅的客户百分比 | 表明客户满意度和潜在的客户保留问题 |

| 客户获取成本(CAC) | 获取新客户的总成本 | 帮助评估营销和销售效率 |

| 客户生命周期价值 (LTV) | 在整个客户关系期间预期从客户获得的总收入 | 衡量客户关系的长期盈利能力 |

| 财务健康指标 | ||

| 燃烧率 | 公司花费现金储备的速度 | 对于初创企业了解财务可持续性至关重要 |

结论

许多SaaS组织发现,财务建模和预测是优化策略的有用工具。这主要是因为他们使用数据和实时洞察来进行评估。

使用财务建模和预测时,重要的是个性化方法以适应您的特定需求。