Financial Management

What is SaaS Financial Modeling?

What is financial modeling in SaaS?

In the SaaS (software-as-a-service) landscape, financial modeling refers to building different presentations of an organization’s financial performance. This is achieved by either using specialized software or, in the traditional manner, through spreadsheets.

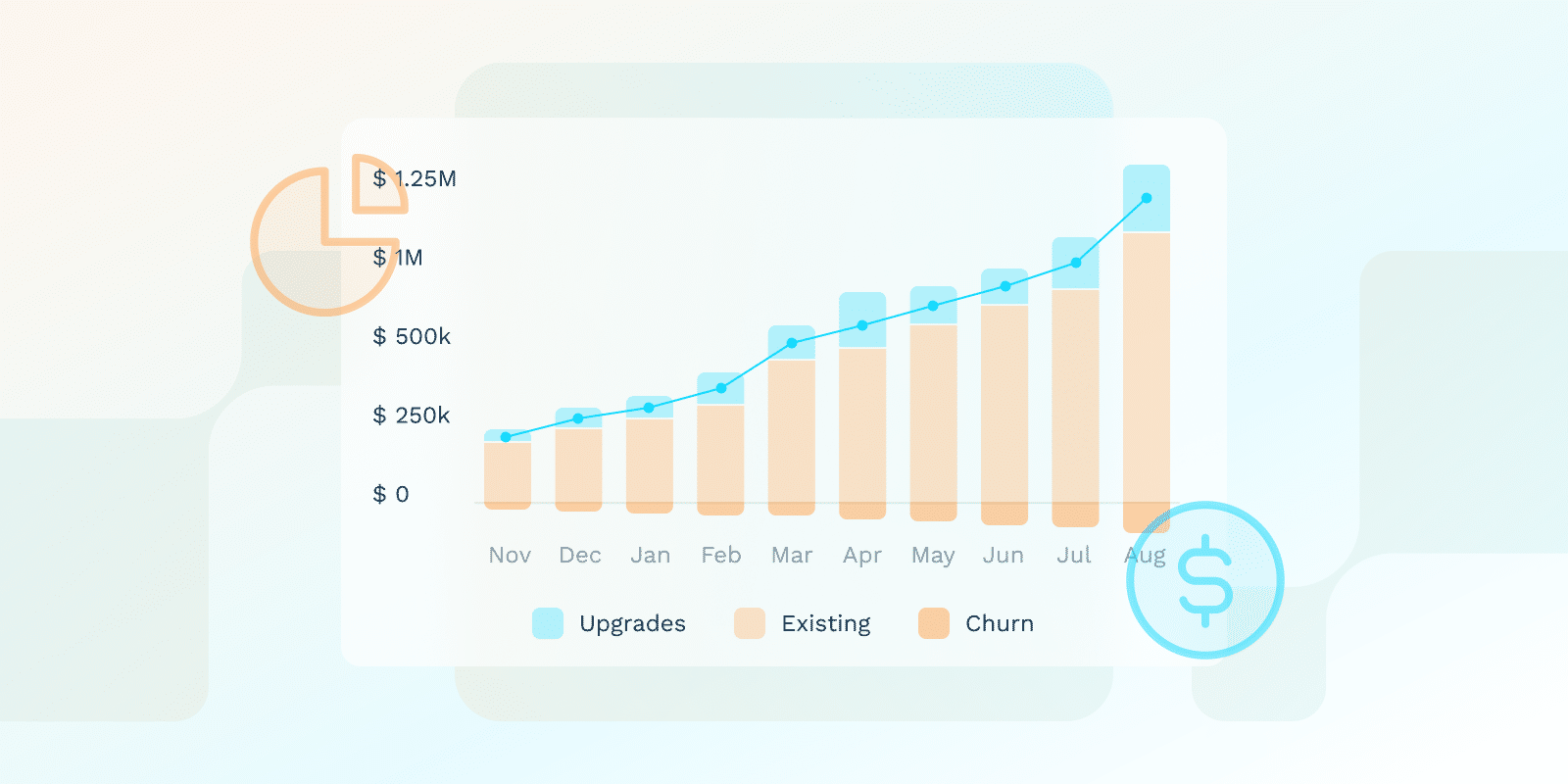

Financial modeling looks at specific SaaS metrics like Monthly Recurring Revenue (MRR), churn rate, customer acquisition cost (CAC), and customer lifetime value (LTV) to forecast income.

For SaaS founders, this method is key to determining future financial outcomes and making business calls based on real data or insights.

How do you forecast revenue for a SaaS business?

Considering that the preferred business model for SaaS products is the subscription pricing strategy, income forecasting forecasting revolves around the concept of recurring revenue. Here are some of the key elements part of the process:

- User Acquisition: Try to approximate how many customers your SaaS product will gain in a specific timeframe.

- Churn Rate: Estimate how many users are going to cancel their subscription within the same timeframe.

- Expansions: Consider the potential revenue gained through upgrading, upsells, cross-sales, or add-ons.

- Contraction: Make an assessment of the possible loss of income generated by downgrades.

All of these points combined can help SaaS businesses forecast revenue and optimize both pricing and budget allocation.

What are some key SaaS metrics to track in a financial model?

When using financial models to track revenue, SaaS organizations should monitor several SaaS metrics.

Monthly Recurring Revenue (MRR) is a reliable benchmark that looks at the monthly income generated by a SaaS company.

Another metric to monitor is the churn rate with indicates the number of users that have canceled their subscriptions. This is directly linked to customer retention, and the higher the percentage is, the lower the retention rate will be.

Next, SaaS businesses need to be aware of how much acquiring new customers costs them through the Customer Acquisition Cost (CAC). On the other hand, analyzing Customer Lifetime Value (LTV) shows how profitable user relationships are by evaluating the total revenue expected from a customer.

Burn rate is a SaaS metric that should be regularly tracked to identify the rate at which an organization spends cash. This is a relevant metric for start-ups.

| Metric | Definition | Importance |

|---|---|---|

| Revenue Metrics | ||

| Monthly Recurring Revenue (MRR) | Total predictable revenue generated monthly from subscriptions | Provides stable income benchmark and helps forecast financial performance |

| Customer Performance Metrics | ||

| Churn Rate | Percentage of customers canceling subscriptions in a given period | Indicates customer satisfaction and potential retention issues |

| Customer Acquisition Cost (CAC) | Total cost of acquiring a new customer | Helps evaluate marketing and sales efficiency |

| Customer Lifetime Value (LTV) | Total revenue expected from a customer throughout their relationship | Measures the long-term profitability of customer relationships |

| Financial Health Metrics | ||

| Burn Rate | Rate at which a company spends its cash reserves | Critical for startups to understand financial sustainability |

How can financial modeling help optimize pricing for SaaS products?

SaaS pricing optimization is an ongoing task, and financial modeling can be of help. Here is how:

- Experiment with scenarios: Test different pricing tactics and strategies and evaluate their impact on the company’s profitability level. Check if, n any of the scenarios tested, greater revenue was generated.

- Match price points with product value: Collect data insights and consider transitioning to value-based pricing. Determine your product’s perceived value and align your price with it.

- Asses your product costs: To obtain a healthy profit margin, it is important to be aware of your product’s developmental, marketing, and support expenses.

What are the best practices for revenue recognition in SaaS accounting?

Revenue recognition must follow specific guidelines, also known as best practices, to provide valid results.

Understand and align your revenue recognition process with the widely recognized accounting standard, ASC 606. This is a widely recognized accounting standard. Also, identify contractually established service periods and payment structures. This is key to gaining clarity when forecasting income.

Consider spreading income across the service period instead of receiving it all upfront and using dedicated software to recognize revenue and achieve SaaS compliance.

Conclusion

Many SaaS organizations find that financial modeling and forecasting are helpful tools in optimizing strategies. This is mostly because they use data and real-time insights to make their assessments.

What is relevant when using financial modeling and forecasting is personalizing the methods to fit your specific requirements.