SaaS Metrics and KPIs

What is the SaaS Churn Rate?

What is the SaaS churn rate?

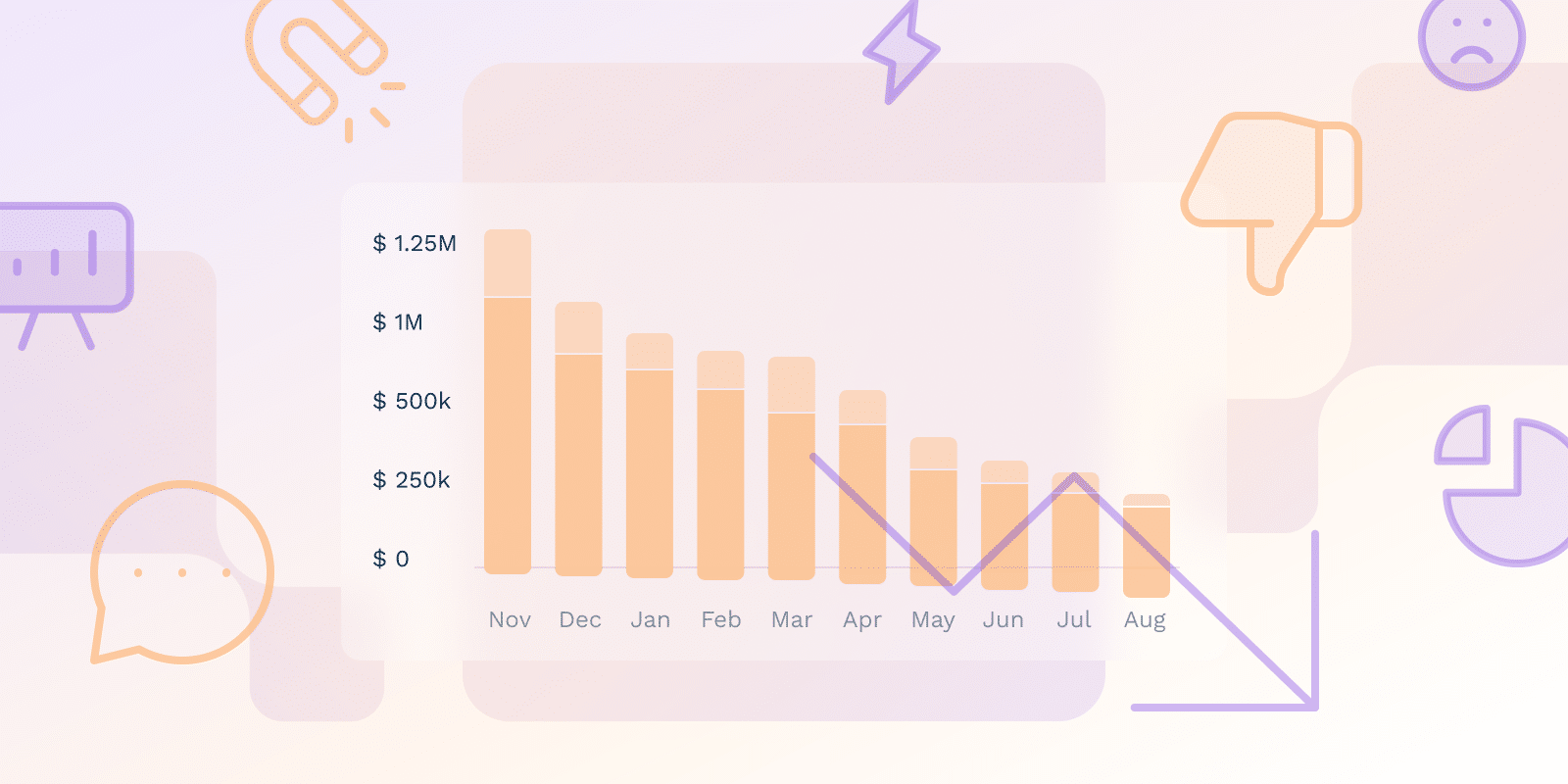

The rate at which users discontinue paying for or utilizing a SaaS product within a specified time frame is known as SaaS churn. It’s a crucial indicator since it shows client attrition, which affects lifetime value, retention, and, eventually, profitability. The churn rate is essential to anticipate income and determine the probability of customer cancellation. Churn has a direct impact on key performance metrics, including growth, ARR, MRR, and renewal rates, and is strongly correlated with customer satisfaction for well-established SaaS enterprises.

Why is churn the most important metric for SaaS companies?

Since it shows how many users are abandoning your SaaS product, which has a direct effect on your income and growth, churn rate is the most crucial metric. Changes in customer retention levels can affect opportunities to expand clientele and increase sales. You may determine the reasons behind customer unhappiness and make the required adjustments to keep clients by keeping a careful eye on your churn rate. A high churn rate has the potential to impact the long-term viability and financial stability of your SaaS business; timely action to manage it is crucial for securing its future success.

How do you calculate the churn rate?

To calculate your SaaS churn rate, use the following formula:

SaaS Churn Rate = Number of Churned CustomersNumber of Customers at the beginning of the period x 100

For example, if you started the month with 1,000 customers and lost 50 during the month, your churn rate would be 5% (50 / 1,000 = 0.05 * 100 = 5%).

How does customer churn differ from revenue churn?

Revenue churn and customer churn represent two key metrics that measure the financial impact of customer losses and the rate at which customers discontinue their services, respectively. A more accurate evaluation of the effect on a business’s financial health is made possible by revenue churn, which considers the revenue produced by each client.

Monitoring both indicators offers a more thorough comprehension of how churn affects the company. While customer turnover provides some insight into the financial effects, it doesn’t fully capture the impact, especially when considering premium members.

What are the key reasons behind customer churn?

Several things might lead to customer attrition, including:

- inconsistent pricing

- flaws in the product

- pressure from competition

- company-wide operational changes

- low perceived value

- subpar customer service

- limited leadership access.

Businesses can reduce turnover by implementing policies like competitive pricing, better product quality, better customer service, and open contact lines with executives. To properly customize solutions, it is essential to pinpoint the precise causes of client attrition.

Why do some companies struggle with prioritizing churn reduction?

While churn reduction is a crucial business objective, some factors can make prioritizing difficult. These include:

- limited awareness of the financial impact of churn

- inadequate data to identify at-risk customers

- limited customer support resources

- onboarding processes that do not create a seamless and positive user experience.

Businesses that successfully handle these areas can boost customer loyalty, build brand reputation, and retain customers while creating new business prospects. Neglecting churn reduction can have negative effects like decreasing client lifetime value, lost income, and slowed growth. Neglecting churn reduction can have negative effects like decreasing client lifetime value, lost income, and slowed growth.

What are the different types of churn?

Churn can be broadly categorized into various types, including voluntary churn, involuntary churn, customer churn, revenue churn, product churn, downgrade churn, upgrade churn, and seasonal churn.

Businesses, especially SaaS organizations, must comprehend these many forms of churn to properly customize their retention tactics and deal with the underlying reasons for client attrition.

Companies can take focused measures to increase client retention and guarantee revenue stability by determining the precise forms of churn that are impacting their operations. Ignoring churn can impede business growth and result in large financial losses. Long-term success thus depends on proactively managing churn through efficient retention tactics.

| Churn Type | Definition | Key Characteristics |

|---|---|---|

| Customer Intention | ||

| Voluntary Churn | Customers actively choose to discontinue service | Driven by dissatisfaction, better alternatives |

| Involuntary Churn | Customers unintentionally stop using the service | Caused by payment failures, expired cards |

| Measurement Perspective | ||

| Customer Churn | Number of customers lost | Indicates customer retention rate |

| Revenue Churn | Financial impact of lost customers | Considers revenue per customer |

| Product & Pricing Dynamics | ||

| Product Churn | Customers switching between product tiers | Reflects product feature satisfaction |

| Downgrade Churn | Customers moving to lower-priced tiers | Indicates reduced perceived value |

| Upgrade Churn | Customers moving to higher-priced tiers | Signals positive product experience |

| Seasonal Churn | Fluctuations in customer base due to seasonal factors | Varies based on industry and business model |

How can you identify customers at risk of churning?

Companies can identify clients who are likely to leave by using data-driven strategies. These tactics include:

- conversation intelligence platforms, which examine customer conversations to find churn risk indicators

- predictive analytics, which evaluates patterns in customer data to predict churn likelihood

- cohort analysis, which assists in tracking customer activity within particular groups

- monitoring company-level changes, like mergers or acquisitions, that may affect customer behavior.

To identify at-risk clients early on, it is crucial to collect insights from multiple sources. Early detection of these clients allows companies to solve their issues and possibly win back their business proactively. It’s crucial to remember that these strategies ought to be customized for the particular business model and industry.

Conclusion

A crucial indicator for SaaS businesses is the churn rate, which shows how frequently customers discontinue using or paying for their services. Businesses may identify consumers at risk and plan to increase customer retention and lower churn by knowing the various forms of churn and its main causes. For long-term success, churn reduction must be prioritized; otherwise, revenue loss, a decline in client lifetime value, and slowed growth may result. Businesses may guarantee client loyalty, enhance their reputation as a brand, and seize fresh growth prospects by proactively managing churn.