What is Committed Monthly Recurring Revenue (CMRR)?

Indicateurs clés de performance et mesures SaaS

What is CMRR (Committed Monthly Recurring Revenue)?

CMRR shows organizations’ expenditures in relation to investments, resource availability, and staff quotas. In contrast, revenue through subscriptions only takes bookings and churn into account.

Utilizing CMRR within a SaaS environment, companies can estimate their future earnings based on their contractual recurring revenue commitments.

Keep in mind: CMRR is a report for the future, so it does not coincide with actual revenue receipts.

What's the difference between CMRR and MRR?

CMRR and MRR are performance indicators for SaaS business.

MRR (Monthly Recurring Revenue) is the revenue accrued from active subscriptions over the last 30 days, whereas CMRR views the future.

The CMRR formula includes MRR and anticipates various possible outcomes, including subscriber churn, plan adjustments, and changes in paid plans, providing a comprehensive perspective.

Anticipated subscriber cancellation strengthens CMRR since it makes more sense of the operational ability than MRR, which has a limited view.

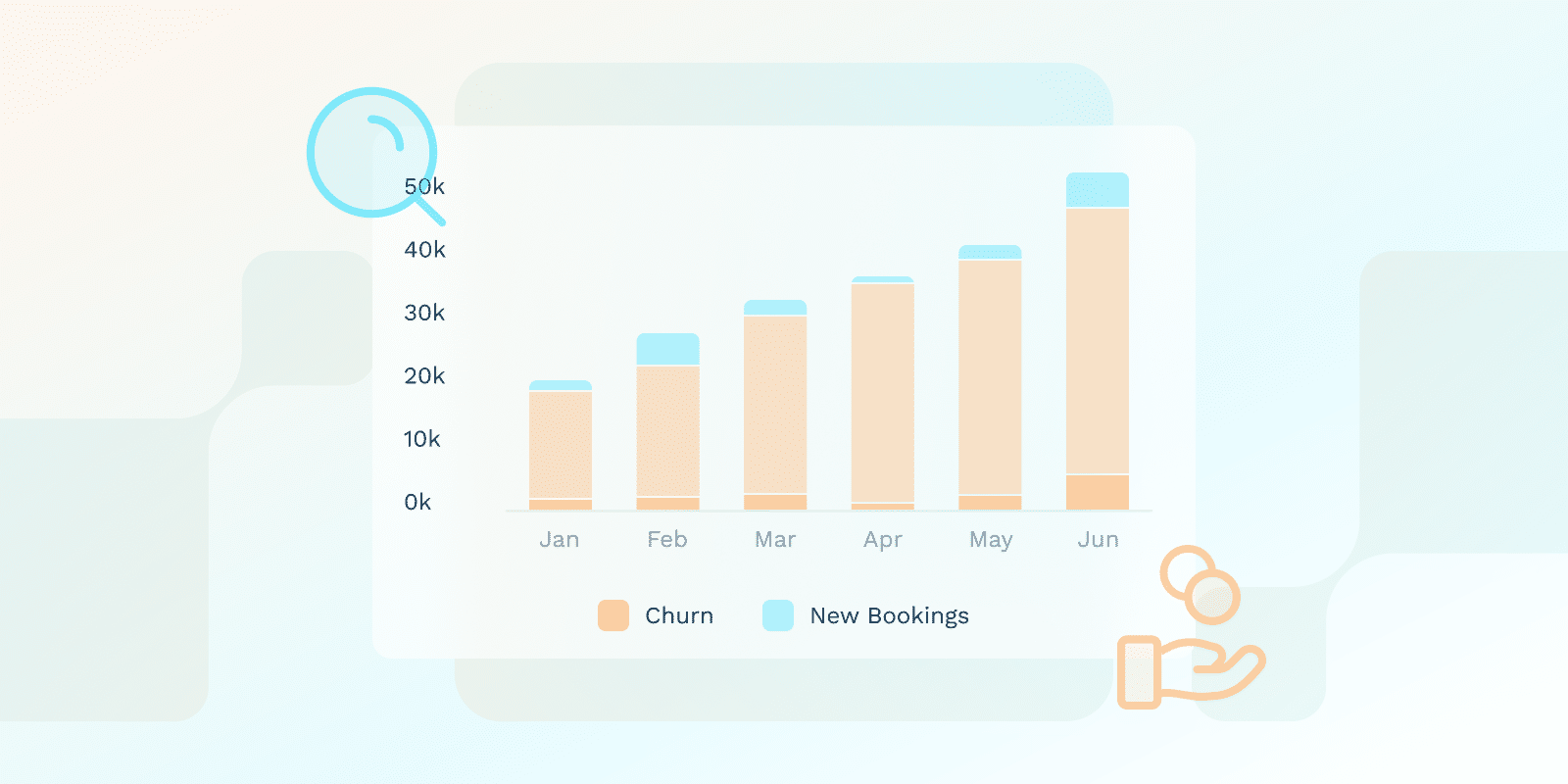

The formula for calculating CMRR is: Ending CMRR = Beginning CMRR + New Bookings CMRR + Expansion CMRR – Churned CMRR.

What are the key benefits of using CMRR?

Gathering data on CMRR (Committed Monthly Recurring Revenue) can be relevant for making strategic decisions about growth and investment.

Prévision des revenus provides insights for strategic budget allocation and resource distribution based on anticipated future needs.

CMRR is particularly relevant for recurring subscription-based companies as it forecasts recurring revenue and overall financial performance. It also:

- The forecasting of monthly recurring revenue (MRR) is refined by considering prospective contractions and upsells.

- Offers a full breakdown of total expected cash flows, including cash flows from future new customer acquisitions and the possible loss of some customers.

- Tackle customer turnover through early prediction of potential churn.

- Depicts emphasis on booking new business since churn may be mistaken for businesses that have shorter selling cycles.

How can businesses increase CMRR?

Businesses can potentially influence CMRR through strategies to improve La fidélisation de la clientèle, potentially mitigating customer losses and promoting upsells. It is essential to pinpoint the drivers of CMRR by identifying churn, upgrades, or downgrades and improving subscription services.

In terms of booked monthly contract revenue and planned contract changes, CMRR has also been altered, so improvement in this direction will also maximize CMRR.

Companies should put measures in place to improve customer retention by incorporating expected churn in CMRR calculations.

What is considered a good CMRR for a SaaS model company?

For a SaaS company, a good CMRR demonstrates growth and stability. Although there is no magic number that would apply to all situations, when reporting CMRR, a net gain in subscriptions and growing CMRR is typical.

Keep in mind that the relationship between CMRR and a SaaS company’s growth outcomes may be influenced by various factors, including a favorable CMRR.

- A CMRR is a valuable metric for SaaS companies looking to raise funding and gain investors, as it reflects the company’s ability to generate revenue effectively and cover its costs.

- A high CMRR indicates a likelihood for a SaaS company to secure future business opportunities, although other factors may influence the outcome.

- The relationship between churn mitigation and market growth is intricate, and reduced churn might be a contributing factor that could influence market expansion.

- While a high CMRR is often associated with a more favorable fundraising environment, a low CMRR does not automatically disqualify a SaaS business from securing funding.

What method do businesses use to track CMRR data?

CMRR data tracking logic takes actual MRR for a monthly period plus current cumulative bookings and churn data. This method involves recording all the irregular orders of booking, amendments of contracts shown in schedules, and planning the revenue every month.

In any organization, the management, and calculation of CMRR should entail using several automated tools and software that boost effective tracking.

Key metrics under the SaaS model are MRR, bookings, cancellations, and downgrade expenses, all of which can be monitored in real-time to calculate CMRR. Since a subscription is not stagnant, systems that monitor CMRR should also be flexible enough to help to capture CMRR accurately.

Conclusion

Committed Monthly Recurring Revenue (CMRR) is a crucial metric for SaaS companies, providing a more accurate picture of future earnings than MRR by factoring in churn, plan adjustments, and changes in paid plans.

The use of CMRR can inform strategic decision-making and resource allocation for SaaS businesses by providing potential revenue, cash flow, and churn projections.

SaaS companies use CMRR to analyze their operations, customer relationships, and funding structure to pinpoint areas related to achieving sustainable growth.