From Checkout to Payout

You’ve built a great product — but selling internationally comes with endless complexities: taxes, compliance, payment issues, fraud risks, and more. It’s overwhelming.

That’s Where We Come In.

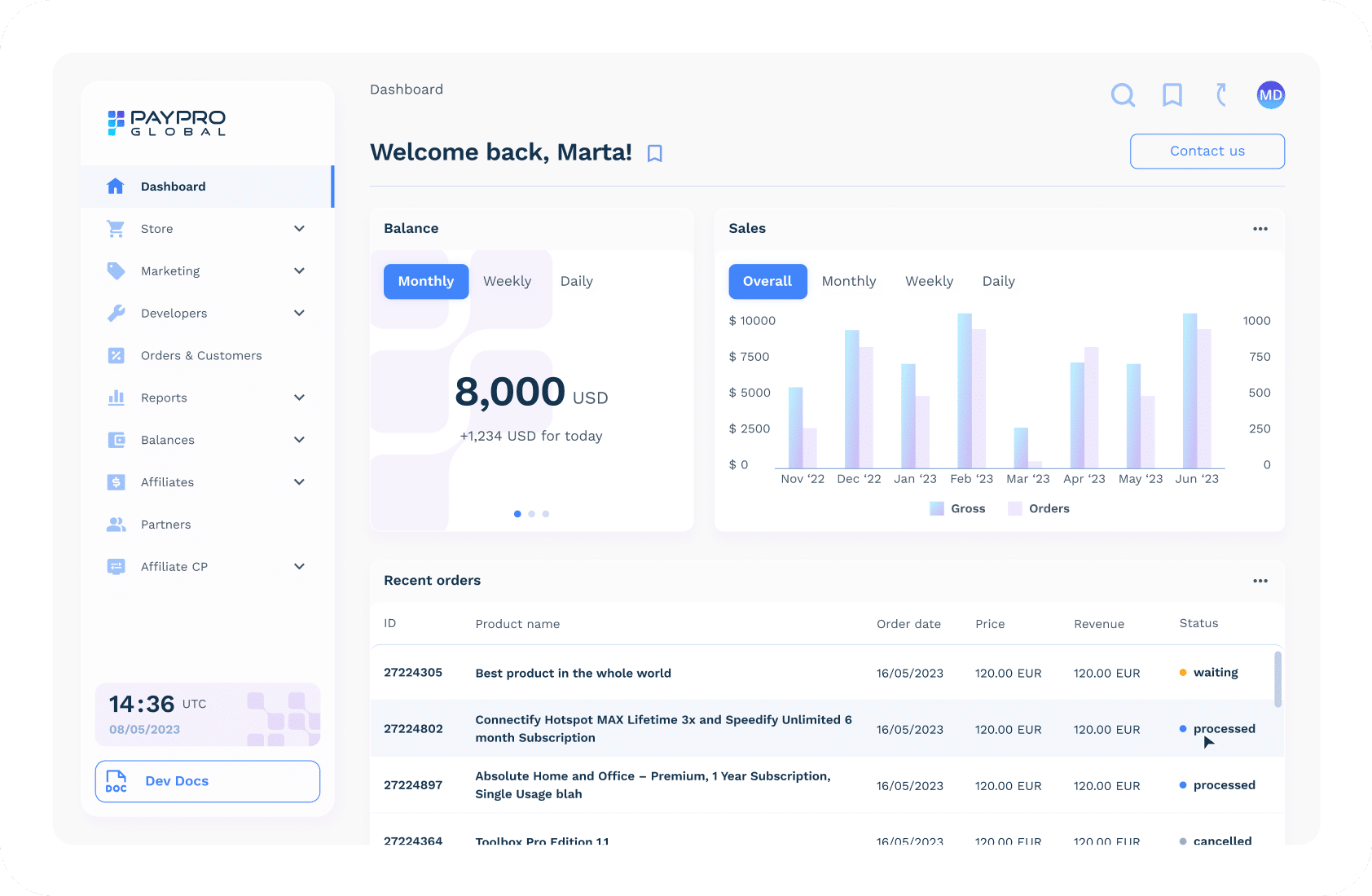

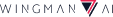

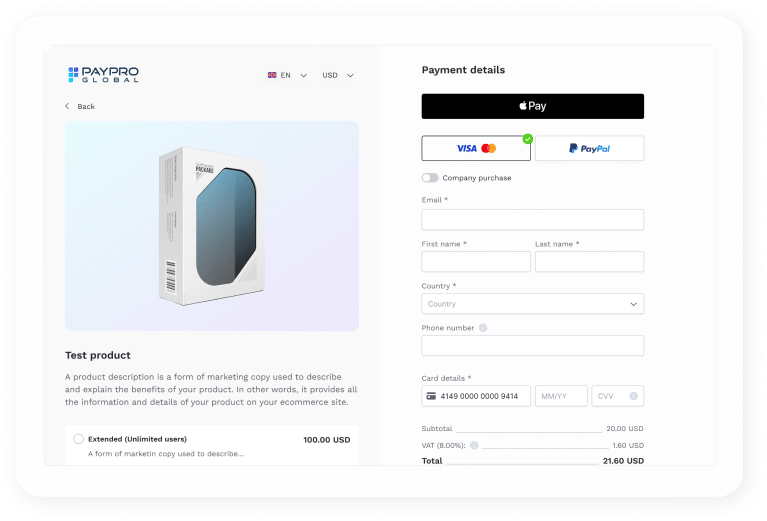

At PayPro Global, we act as your Merchant of Record, managing the entire sales and tax infrastructure so you don’t have to.

Here’s how it works