How To Find, Attract, and Get SaaS Startup Funding

To successfully get funding for your SaaS startup, be certain you fully understand your funding needs to prepare your business, and effectively present your case to investors. It can be expensive to develop, deploy, and sell software online, especially at the early stage of a startup, so securing Startup funding can be critical for the survival of SaaS companies.This guide explores the SaaS funding landscape, presenting a step-by-step approach to navigate the process.

Determine Your Startup Stage and Funding Needs

Understanding how the funding ecosystem works can be a complex process, requiring careful analysis. Before you can sell SaaS online, knowing who you should get startup SaaS funding from and precisely what funding you need is essential. To make the right choice for your SaaS, you must do some housekeeping first.

Start with identifying your startup’s stage and align it with the appropriate funding type. The stage at which SaaS companies are operating helps determine the kind of funding they should chase. We briefly outline the stages below:

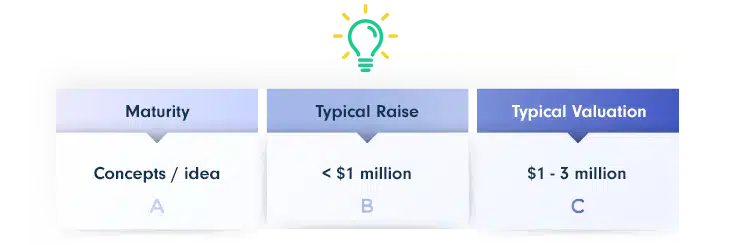

Pre-Seed Startup Stage

The pre-seed stage is reserved for the smallest SaaS companies. Early-stage startups seeking this type of funding might require assistance in constructing a functional prototype or introducing their product to the market.

This may require a small capital of around $1 million or less. Getting pre-seed funding is highly competitive. Investors will be looking for well-developed product ideas and solid founding teams to give them the confidence they need to invest in early-stage startups.

- Characteristics: Idea stage, prototype development, validating market need.

- Funding Needs: Small amounts (under $1 million) for initial development, market research, and building a basic team.

- Funding Sources: Angel investors, friends and family, accelerators, grants, and crowdfunding.

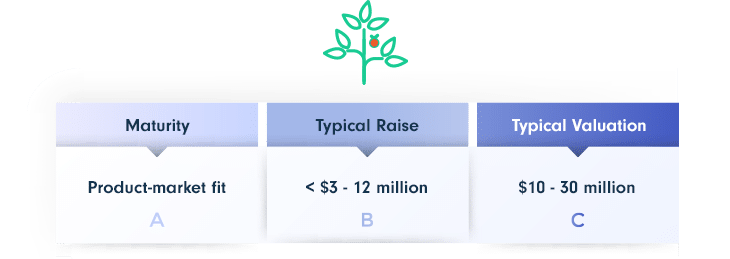

Seed Startup Stage

The seed stage is commonly seen as the first official equity funding stage, with software and SaaS companies needing to raise between $100,000 and $2 million. You need capital to help meet your product development needs, expand your team, and begin turning a profit at this early stage. Going for SaaS Open Source as a development method is an option for several company founders.

Learn how to build an MVP for your SaaS that is operational, achieving initial customer engagement and establishing a user base, which are key milestones for seed funding.

To qualify for funding, your business must have more or less doubled in valuation since the pre-seed round. And, as Investopedia reports, your business should be valued between $3 million and $6 million, though these are broad guidelines.

- Stage:Minimum Viable Product (MVP) operational, achieving initial customer engagement and learning how to get your first 100 customers to establish a user base and demonstrate market traction.

- Funding Needs: Larger amounts ($100,000 – $2 million) for product development, marketing, and hiring.

- Funding Sources: Angel investors, seed-stage VC firms, accelerators.

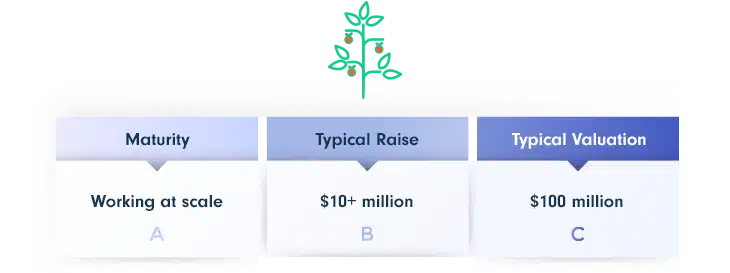

Series A – Revenue Generation

The Series A funding stage may come into consideration for SaaS or Software businesses once they have established revenue streams and are pursuing growth opportunities. At this stage, you need capital to optimize existing business processes, like understanding how to improve the SaaS customer onboarding experience, which can greatly help boost conversion rates or reduce customer churn.

While the scale of this funding varies, businesses raise around $10 million on average. To attract investors, you’ll need to develop your business model further and show evidence that it can withstand future cash flow fluctuations.

- Main Points: An established revenue model, a customer base experiencing growth, and an expanding operational scope.

- Funding Needs: Significant capital ($10 million on average) for scaling operations, expanding marketing, and product enhancements.

- Funding Sources: Series A VC firms, growth equity firms.

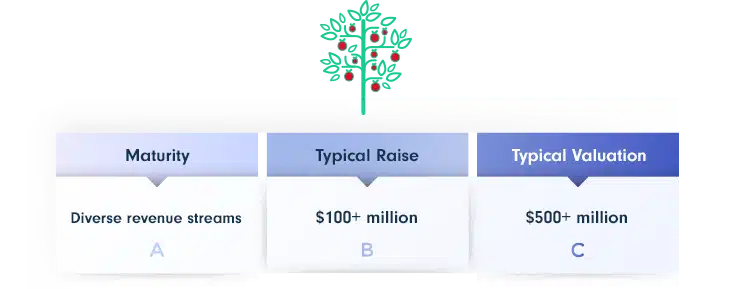

Series B – Equity-based funding

Series B funding is a form of equity-based funding where you sell shares in your company to investors in return for capital. This capital acts as a cash injection to boost your growth.

The Corporate Finance Institute (CFI) notes that SaaS companies looking for Series B funding need strong valuations of about $10 million. To secure funding, your monetization strategy must have succeeded. In addition, you need to demonstrate that your product is profitable and have metrics that prove your business can compete at a certain level.

- Main Points: Profitability, consistent growth, and established market presence.

- Funding Needs: Larger investments to fuel further expansion, enter new markets, and potential acquisitions.

- Funding Sources: Late-stage VC firms, private equity firms.

Series C – Final stage funding

This is the final funding stage. In 2019, Series C Startups raised an average of $103 million, up from $48 million in 2012.

This stage focuses on aggressive expansion. Your SaaS or Software company should generate sufficient capital for scaling so that investors will get less equity. To qualify for funding, your business must be established enough that the investment risk is low.

- Critical elements: significant revenue generation, a well-founded market position, and the sustained pursuit of growth.

- Funding Needs: Substantial capital for acquisitions, understanding how to expand your SaaS business into new countries, and new product lines are common uses for Series C funding.

- Funding Sources: Late-stage VC firms, private equity firms, strategic investors.

Free Investor Due Diligence Template

Find the perfect funding partner for your SaaS startup.

-

Key questions to ask potential investors

-

Framework for assessing investor fit

-

Resources for gathering essential information

-

and more tips for building strong investor relationships.

Prepare Your Business for Funding

Once you’ve determined the SaaS Startup funding stage you’re in, it’s time to get prepared for your funding journey. Here are a few tips:

Develop a Compelling Business Plan: You’ll need a detailed business plan for using your Startup funding to grow your SaaS company. You need to include details regarding further investments for different optimization tasks like improving the SaaS user onboarding.

- An executive summary outlining your company’s mission statement and a clear description of your products or services.

- A company description outlines your business goals, your target market (which you can detail by learning how to define your SaaS Ideal Customer Profile (ICP)), and the solutions you can offer them.

- A market analysis highlighting your business’s strengths and how these compare to competitors. Demonstrate your understanding of the market, including size, and trends.

- A clear description of your team, including their roles and responsibilities.

- A marketing plan outlining advertising budgeting, target customer selection, and promotion strategies aimed at enhancing SaaS customer retention via diverse channels.

- A sales plan that documents sales reps needed, along with plans for onboarding sales staff or outsourcing these services.

- A request for funding stipulating the size of the investment you need and how you’ll use the capital you’ve raised.

Prepare Financial Projections showing the financial goals you’ve set for your business. Make sure you base these on market research.

- Revenue Projections: Develop realistic revenue forecasts based on your pricing model, customer acquisition strategy, and market growth.

- Expense Budget: Outline your anticipated expenses for product development, marketing, sales, and operations.

- Traction and Metrics: Showcase your key performance indicators (KPIs) and achievements. To stand a fighting chance of finding SaaS Startup funding, here are key metrics you’ll need to get ready:

|

Metric |

Why |

|

Monthly Recurring Revenue (MRR) |

projections show your business’s viral growth potential, making it an essential metric for obtaining SaaS Startup funding.It indicates how you maintain your customer relationships and how well your service fits into the market. |

|

Customer Acquisition Costs (CAC) |

providing investors with data highlighting your model’s functionality and your sales team’s ability to handle demand volume helps them assess the likelihood of meeting quota targets. Demonstrating your ability to acquire new customers could potentially play a role in funding decisions. |

|

Average Revenue per User (ARPU) |

shows investors how much revenue your customer base generates for you on average. It provides investors with insight into the effectiveness of your business model, which may influence their decision to invest in your SaaS Startup. |

|

Customer Lifetime Value (CLTV) |

refers to the total amount of money a user will spend on your product if you keep them as a customer. Customer lifetime value (CLTV) is a crucial metric that reflects ongoing customer engagement and value creation. |

|

Low Churn Rates |

It’s crucial to consider the role of SaaS in securing funding for your startup. Churn metrics measure the rate at which customers discontinue using a service over a given period. Keeping your churn rate low is essential for two reasons: Low customer churn may be associated with high SaaS user retention, potentially attracting investor attention. Customer retention is associated with consistent income and lower expenses for acquiring new customers. To maintain a healthy rate of growth, keeping your churn rate low is often beneficial. While demonstrating long-term viability may not guarantee investor support, it can be a significant factor in their decision-making process. |

Build a Strong Team:

- Founders: Demonstrate your experience, passion, and commitment to the business.

- Advisory Board: Assemble an advisory board with relevant industry expertise.

- Key Hires: Recruit talented individuals for critical roles in product development, marketing, and sales.

Develop a Pitch Deck, alongside a professional business plan, which should include:

- Problem: Clearly define the problem you are solving for your target market.

- Solution: Explain your unique solution and its key features and benefits.

- Market Opportunity: Showcase the size and potential of your target market.

- Traction: Present your key achievements, milestones, and traction metrics.

- Team: Introduce your team and their relevant experience.

- Business Model: Explain your revenue model and detail how you plan to price your SaaS product as part of your overall pricing strategy.

- Financial Projections: Present your financial forecasts and funding needs.

- Call to Action: Clearly state your funding request and next steps.

Refine Your Value Proposition:

- Unique Selling Proposition (USP): Identify what sets your SaaS solution apart from competitors.

- Customer Benefits: Clearly articulate the value your product or service provides to customers.

- Comparative Analysis: Examine the strengths and weaknesses of your solution relative to alternatives.

Gather Supporting Documentation:

Organization plays a crucial role in securing SaaS Startup funding. Prepare your business plan, pitch decks, and financial projections. It’s also helpful to update any legal documentation like your articles of incorporation – the set of documents you must file with a government body to document the establishment of your company.

- Legal Documents: Prepare your articles of incorporation, operating agreement, and any relevant licenses or permits.

- Financial Statements: Gather your financial statements, including income statement, balance sheet, and cash flow statement.

- Intellectual Property: Secure any trademarks, patents, or copyrights related to your product or service.

Your business requires your attention. Do not overlook its needs. Make sure your business doesn’t suffer while looking for funding, as any decline in growth could deter future investors. Double your marketing efforts to help reduce customer churn.

Free Investor Due Diligence Template

Find the perfect funding partner for your SaaS startup.

-

Key questions to ask potential investors

-

Framework for assessing investor fit

-

Resources for gathering essential information

-

and more tips for building strong investor relationships.

Explore Funding Options

The various funding ecosystems have different legal, logistical, and practical requirements. You need to understand these thoroughly before choosing the best option. Though in-depth research requires an initial time commitment, it can potentially lead to time and cost savings in the future.

We’ve put together a list of some of the most popular Startup funding options for SaaS companies, taking a closer look at the pros and cons:

- Venture Capital

Venture capital (VC) firms raise money by asking a group of partners to contribute to their investment fund, usually investing in Startups with promising growth potential. Sometimes confused with Private Equity (PE), both raise capital from limited partner (LP) investors and invest in privately-owned companies.

However, there are significant differences in how venture capital and private equity firms conduct business, such as the companies they invest in, the levels of money they provide, and the amount of equity they want for their investment.

Venture Capital usually generates less than 50% of the company’s equity. The financial risk of early-stage startup investment means VCs prefer to spread smaller amounts of money over more businesses. Venture capital stands out as a prominent funding source for SaaS startups within the private market.

|

‘PE’ vs ‘VC’ |

Private Equity |

Venture Capital |

|

Stage |

Purchase well-established, public companies |

Usually invest in startup and early-stage companies |

|

Company Type |

Buys companies across all industry types |

Invests in technology companies, including bio and clean tech |

|

% Acquired |

Almost always buys 100% of a company |

Usually acquires a minority stake of 50% or less |

|

Size |

Make large investments from $100 million to $10 billion |

Often smaller investments of $10 million or under |

|

Structure |

A combination of equity and debt |

Only use equity (cash) when making purchases |

According to Forbes, venture capital funding is usually between $1 million and $5 million. Venture capitalists require company valuations ranging from $5 million to $15 million for Series A funding. To secure VC funding, you’ll have to prove your business has the potential to grow substantially. Venture capitalists will want to see metrics that indicate the value of SaaS companies, so be prepared to answer a few tough questions.

- Pros

Access to substantial financial support, often associated with venture capitalists. On average, a venture capitalist firm manages about $207 million in venture capital for its investors annually.

While not a guarantee of success, the presence of venture capitalists in a SaaS company’s funding rounds can act as an indicator of its perceived viability, potentially influencing the market’s perception and social validation. Venture capital involvement suggests potential industry recognition and perceived value, which might affect customer perception and trust.

Securing follow-on investment tends to be facilitated by demonstrating early traction. Securing funding in the initial round may not guarantee additional funding, but it could potentially influence the venture capital firm’s level of trust and willingness to provide further support in subsequent rounds.

- Cons

Venture capitalists might request equity or board seats in your SaaS company in exchange for funding. Implementing this system will involve delegating some aspects of your business operations to an external entity.

You’ll be required to provide water-tight metrics that prove you’re performing well. Note that checking your metrics may require some time-sensitive research, potentially influencing the timeline for receiving funding.

The alignment of interests between the venture capitalist and the founder is often strong, but their conflicting opinions on specific aspects of running the business could arise due to different perspectives.

-

Angel Investors

Angel investors are usually individuals (rather than a fund or firm) that personally invest in your business. You give up an equity stake in exchange for the funding.

Typically, angel investors provide less capital than venture capitalists. According to the Angel Capital Association, these investors are likely to commit between $5,000 and $100,000. In comparison, VC firms usually invest an average of around $2.5 million in capital, though these values can be pretty broad.

Angel investors are more likely to provide you with funding if your business is in its earlier stages of development.Generally, these investors look for innovative companies with the potential for a high revenue turnover within the first three to seven years.

- Pros

Due to the independent nature of angel investors, their involvement in your venture may extend beyond purely financial matters. Their role could involve providing business guidance through a mentoring approach.

Investor engagement through one-on-one interactions could have an impact on funding stability. Demonstrating trustworthiness to investors may influence their receptivity to future funding possibilities.

Angel investors are more open to risks than other investors. They don’t answer to any regulatory board, so decision-making processes are less encumbered.

- Cons

Angel investment can result in high financial commitment, and while potentially offering high returns, its success is not guaranteed. Significant capital investment often leads to high ROI expectations, potentially reaching 10x within a five to seven-year timeframe.

Angel investors typically operate individually, with fewer established oversight procedures for their requests compared to traditional investors. While angel investors provide valuable resources, their autonomy could potentially be misused by some to exploit less experienced business founders.

The availability, energy, and expertise of angels vary, so it’s worth doing your homework on them first.

- Accelerators and Incubators

Incubators are physical spaces that offer a combination of office space, funding, and expertise. These spaces are mostly ‘rented’ in exchange for monthly membership fees or, less frequently, equity.

While Incubators can offer benefits such as training, network introductions, and equipment, it is important to consider specific needs and match them to the services provided. As such, they’re best suited for the seed stage.

An accelerator is a business program that’s usually run with private funds. Forbes reports that accelerators usually offer seed money in exchange for business equity, with investments ranging between $10,000 and $120,000.

Entering a later growth stage? These programs offer temporary support, mentorship, access to investors, financing, and educational resources, helping startups progress.

- Pros

These two are commonly preferred by leading experts in the industry. These networks may provide assistance to other entrepreneurs, though the extent and form of support may vary.

Both are associated with increased credibility. Acceptance into an incubator or accelerator program may affect competitor perception of your growth potential.

- Cons

The increasing popularity of incubators and accelerators affects program entry’s competitiveness.

According to Holloway, most accelerators require 2-10% equity in your business in exchange for their services.

Be aware of the impact of the program’s cost, whether it is a monthly fee or equity. However, they do not necessarily guarantee an increase in capital.

- RBF – Revenue-Based Financing

Revenue-based financing (also known as royalty-based financing) is a method of raising capital. SaaS companies receive a loan from a group of investors, who in turn receive a percentage of the company’s ongoing gross revenue (rather than equity) in exchange for the investment.

With an RBF, investors receive a regular share of the business’s income until a predetermined amount has been repaid.Usually, this amount is a multiple of the original investment, generally ranging between three to five times the original investment amount.

Although a business that raises capital through RBF will be required to make regular payments to the original investment, it differs from debt financing. The outstanding balance does not accrue interest and payments are not required in predefined amounts.

Instead, you are provided a loan based on your business’s overall revenue, and repayment is a percentage of your monthly earnings, plus a multiplier of the original investment.

- Pros

Once the loan is repaid, the business remains entirely yours as there’s no equity exchange.

Repayment of the loan signifies the culmination of the investment cycle. There would be no further financial gains or returns once the original loan amount has been fully repaid.

- Cons

This product is designed for businesses with established revenue, as the loan provider requires proof of income to assess the loan investment.

While this type of funding can be beneficial, it’s important to remember that it does not come with network assistance, mentorship, or financial advice.

It’s worth considering the financial situation of young ventures, as monthly repayments could pose a challenge.

- Bootstrapping

Bootstrapping is all about building a business from scratch, where an entrepreneur starts a company with little to no capital rather than relying on outside investments to promote growth. A founder can be considered as bootstrapping when they attempt to found and build their company from personal finances and their operation earnings.

This contrasts to acquiring funds through the previous methods we discussed, such as raising capital through angel investors or venture capital firms. Instead, bootstrapped founders rely on their savings, run lean operations, or have a quick inventory turnover. It’s not uncommon for a company to take preorders for a product and use the funds raised to build and deliver the product itself.

Because a business that bootstraps is often working with limited sources of financing, it’s vital to have a competent development strategy where all possible risks will be accounted for. Also, any available funds need to be appropriately reallocated back into the most critical parts of the business model.

It is noteworthy that several prominent SaaS and technology companies originated as self-funded startups. These include a range of companies, such as Facebook, eBay, Basecamp, GitHub, and Plenty Of Fish, to name but a few. Let’s take a closer look at the pros and cons:

- Pros

The need for bootstrapping may lead to the creation of a SaaS product that generates immediate revenue..

Ensuring your ownership and control over the direction of your business is key.

Bootstrapping controls the company and its directions, whereas external funding can mean taking on external pressures and responsibilities to keep investors happy.

- Cons

Scaling, budgeting, and managing your SaaS business is more complex, as you don’t get cash injections from other sources.

SaaS startup funding can differ in the extent of support and resources provided compared to other funding options.

To avoid financial strain, it’s advisable to manage your expenses within your available resources.

- Crowdfunding

Early-stage startups in the software, digital product, or SaaS industry may explore crowdfunding as a potential means of obtaining funding. Rather than more traditional funding methods that rely on financing from one institution such as banks, crowdfunding is a numbers game, gathering small investments from a more comprehensive source of people.

Crowdfunding campaigns typically utilize online platforms, eliminating the requirement for founders to engage in face-to-face meetings with potential investors. Platforms provide multiple pathways for donors to engage and contribute to a range of initiatives, often supported by campaigns that aim to generate interest and collect funds.

There are a few different types of crowding funding available, depending on your particular business, product, and long-term goals.

Reward-based crowdfunding is the one that most people will recognize. In return for a set of fixed donation amounts, investors are usually given a range of offers. These can be in the form of early access or reduced “early bird” prices for products and services, or additional bundled benefits that might not be offered to those who buy into the product at a later date.

Equity crowdfunding most resembles the other forms of gaining investment as it involves giving up a portion of your business in return for investment rather than pre-selling a product. As with other forms of equity investment, the Startup’s success helps determine each investor’s stake value.

Debt (or loan-based) is a lot like getting a loan, except rather than going through a bank, you receive the investment from a series of backers who lend you the money you need to help you get up and running. These backers finance your Startup on the basis that you return their investment plus a fixed interest rate by an agreed time. This is often referred to as P2P (peer-to-peer) lending.

- Pros

It’s an accessible and fast way to raise money, especially for early-stage startups.

You’re in control – you decide what, how, and where you crowdfund.

Democratizes investment challenging the big company status quo while providing a level of transparency.

This strategy is continually evolving and offers new flexibility that traditional options don’t.

- Cons

It requires knowledge of available platforms.

Regulations set limits on the number of investors and the amount of capital that can be raised.

Platform fees, which cover facilitation and payment processing costs, contribute to overall expenditure.

Expert guidance varies depending on the option chosen.

Free Investor Due Diligence Template

Find the perfect funding partner for your SaaS startup.

-

Key questions to ask potential investors

-

Framework for assessing investor fit

-

Resources for gathering essential information

-

and more tips for building strong investor relationships.

Research (Identify) Investors

Once you’ve decided on a SaaS Startup funding option, it’s time to do the research on investors. However, with individual VC firms receiving more than 1,000 proposals a year, there is much more demand than investments available. Investors are picky, so you’ll have to make a strong case or risk losing out.

Identify Potential Investors:

- Venture Capital Firms: Research VC firms that invest in your industry, stage, and business model. Utilize online resources like Crunchbase, PitchBook, and VC-Mapping to identify relevant firms.

Use tools like Apollo.io or Hunter.io to gather contact information (partners, analysts) for VC firms. This allows for more targeted outreach, including their portfolio companies, investment focus, and contact information for partners and analysts. - Angel Investors: Explore platforms like AngelList, Crunchbase, Gust, and Golden Seeds for connecting with angel investors. Use LinkedIn to search for angel investors based on their investment history and industry experience.

Attend startup events and pitch competitions to connect with potential angel investors. - Accelerators and Incubators: Explore programs like Y Combinator, Techstars, and 500 Startups. Research local incubators and accelerators that focus on your industry. Many universities have incubator programs for student-led startups.

- Crowdfunding Platforms:

General Platforms: Consider platforms like Kickstarter, Indiegogo, and GoFundMe for raising funds from a large audience.

Equity Crowdfunding: Explore platforms like SeedInvest, Republic, and Wefunder for raising capital in exchange for equity.

Niche Platforms: Research niche crowdfunding platforms that cater to your specific industry or audience.

Assess Investor Fit: Before approaching any investor, it’s crucial to assess whether they are a good fit for your SaaS startup.

- Investment Focus:

- Industry Alignment: Does the investor focus on your industry (e.g., SaaS, healthcare, fintech)?

- Stage Alignment: Does the investor invest in startups at your current stage (pre-seed, seed, Series A, etc.)?

- Investment Thesis: Does the investor’s investment philosophy align with your business model and growth strategy?

- Investment Size:

- Typical Investment: What is the investor’s typical investment size? Does it match your funding needs?

- Fund Size: For VC firms, consider the size of their fund. Larger funds may be more suitable for later-stage investments.

- Industry Expertise:

- Relevant Experience: Does the investor have experience investing in or working with SaaS companies?

- Network and Connections: Can the investor provide valuable connections and mentorship in your industry?

- Values Alignment:

- Shared Values: Do the investor’s values align with your company’s culture and mission?

- Reputation: Research the investor’s reputation and track record.

- Portfolio Companies:

- Competitive Landscape: Has the investor invested in any of your competitors?

- Success Stories: What is the investor’s track record of successful investments?

Venture Capital Firms: Sequoia Capital, Andreessen Horowitz, Accel, Insight Partners, Bessemer Venture Partners, Lightspeed Venture Partners.

Angel Investors: Jason Calacanis, Ron Conway, Jeff Clavier, David S. Rose, Esther Dyson.

Free Investor Due Diligence Template

Find the perfect funding partner for your SaaS startup.

-

Key questions to ask potential investors

-

Framework for assessing investor fit

-

Resources for gathering essential information

-

and more tips for building strong investor relationships.

Approach Potential Investors

Now, to get SaaS Startup funding, you need to stand out against your competitors. Here are some tips for how to approach potential investors:

Get an Introduction, maybe from a mutual connection, and ask them to set up a meeting between you and the potential investor. Attending SaaS-related events, or connecting on a platform such as LinkedIn, are other ways to get in touch. If you choose to communicate via email, attach a well-structured pitch deck.

Tailor Your Approach:

- Venture Capital: Prepare a detailed pitch deck and financial model.

- Angel Investors: Focus on your story, passion, and potential for high growth.

- Accelerators/Incubators: Highlight your team’s potential and the scalability of your business.

- Crowdfunding: Create a compelling campaign page with a clear value proposition and rewards.

Build Relationships:

- Network: Attend industry events and connect with investors online.

- Warm Introductions: Leverage your network for introductions to potential investors.

- Personalized Outreach: Craft personalized messages that demonstrate your research and genuine interest.

! Be Persistent: Don’t be discouraged by initial rejections.

Follow Up and maintain communication: stay in touch with investors and provide updates on your progress. Schedule regular meetings and calls with your investors to discuss your progress and seek their advice.

Seek mentorship, leverage your investors’ experience and network for guidance and support.

And Build Long-Term Relationships with your investors for potential future funding rounds and strategic partnerships.

Negotiate and Secure Funding

Understand Term Sheets: A term sheet is a non-binding agreement outlining the proposed investment terms. Carefully review key aspects:

- Valuation: The agreed-upon value of your company.

- Equity: The percentage of ownership the investor will receive in exchange for their investment.

- Liquidation Preference: How proceeds will be distributed in the event of a sale or liquidation of the company.

- Anti-Dilution Protection: Protects the investor’s ownership stake in case of future down rounds.

- Board Representation: The investor’s rights to appoint members to your company’s board of directors.

- Protective Provisions: Special rights granted to the investor, such as veto power over certain decisions.

Negotiate Favorable Terms:

- Seek Legal Counsel: Consult with an experienced attorney to ensure your interests are protected.

- Understand Your Leverage: Your leverage in negotiations depends on factors like your traction, market opportunity, and investor interest.

- Focus on Key Terms: Prioritize negotiating terms that are most important to you, such as valuation and control.

This detailed guide outlines a series of potential actions that could potentially have an impact on your ability to secure funding and contribute to the potential growth of your SaaS startup. Success in the competitive world of SaaS funding often necessitates perseverance, thorough business preparation, and a convincing pitch.

Conclusion

We cannot stress this enough; whatever route you choose for your SaaS funding, it’s going to require time and effort to secure. Preparing a funding pitch is an iterative process that will likely involve revisions and rejections. These revisions may be time-consuming, but they also provide valuable opportunities to refine your pitch and maximize its effectiveness.

Prior to initiating discussions with prospective investors, it’s crucial to allocate time for thorough preparation, which may involve developing one-pagers, pitch decks, business plans, and financial projections, among other materials.

For your micro SaaS idea to potentially gain significant traction, be prepared to exert considerable effort and demonstrate strong work ethic. However, recognize that achieving success does not necessitate solitary endeavor. For more information on potential marketing strategies specific to SaaS services, feel free to contact PayPro Global. We might be just the eCommerce partner you were looking for.

FAQ

-

Many startups still depend on venture capital financial backing to fund their software development. Some startups have successfully initiated Kickstarter campaigns, but these are very rare indeed. Most companies have to acquire funding via venture capital.

-

Anyone can be an angel investor, but you have to find the right one to invest in your business. Angel.co is a website featuring a collection of profiles from certified investors seeking new investment opportunities.

-

Despite the vast potential of the startup world, it’s crucial to acknowledge the competitive nature of this realm. Only a minuscule fraction, roughly 6%, of startups ever receive external funding. Achieving sustainable success in this dynamic environment often necessitates significant dedication and perseverance.!

-

Launching a company without financial backing can be accomplished by investing time and effort in constructing your brand, creating and qualifying leads to expand your customer base. The following three actions may enable a company to generate revenue without external funding.

-

The amount of funding you need depends on your startup’s stage and growth plans. Early-stage startups (pre-seed/seed) typically raise smaller amounts (under $2 million), while later-stage startups (Series A and beyond) may require significantly more capital.

-

Research investors online (Crunchbase, AngelList), network at industry events, and leverage your existing network for warm introductions. Focus on investors who align with your stage, industry, and values.

-

Craft a personalized outreach message that demonstrates your research and genuine interest in the investor. Highlight your key achievements and traction metrics, and clearly articulate your value proposition.