How to Manage SaaS Sales Tax (Calculate, Collect And Remit)

You must be vigilant in reporting your income and remain in compliance with tax regulations to avoid penalties. Whether you are an Indie developer or a SaaS entrepreneur, understanding tax management is your responsibility. Let’s go through the steps of overseeing the sales tax process, whether you’re a big or small SaaS company.

Choose a Sales Tax Management Method

How you decide to manage your taxes will affect your time and financial resources, exposure to risk and global reach. Start by identifying key factors such as the complexity of your business, customer locations, expertise and sales volume vs. time commitment.

- In-House: If you’re reading this guide, you probably don’t have the tax expertise you need to manage the calculations, collection and filing yourself:) Please know this is a very time consuming process which requires deep knowledge

- Tax Compliance Tools: To save time and money, you may want to use tax compliance software to automate the process, but know that they may not cover all aspects of compliance. Also, be aware that with most PSPs and tools for compliance, you’ll still be responsible for filing and remitting sales tax, and ensuring overall regulatory adherence like how to ensure GDPR compliance.

- Merchant of Record (MoR): When looking at options suitable for enterprise, SMBs, indie devs and solopreneurs, MoR is a common one about SaaS businesses. Because the MoR acts a reseller but assumes responsibility for sales tax management, this is a choice for companies that want to focus on their product, scaling their business and selling to a wider audience.

Handling all sales tax obligations is the responsibility of the MoR. So feel free to skip over the next part If you have already chosen to partner with an MoR, a decision often detailed in how to choose the right payment solution for your SaaS, because you no longer need to worry about this 🙂

BUT if you’re still using any compliance tools or managing sales tax in house, review the next steps to be sure you aren’t missing anything about the proper way to collect and remit.

Free SaaS Sales Tax Checklist

Download this checklist to navigate sales tax obligations with ease. Covers:

-

Nexus determination

-

Tax calculation

-

Filing procedures

-

and more!

Determine Your Tax Obligations

After choosing your strategy for tax management, you’ll need to understand your specific sales tax responsibilities. Investigate where you have nexus and then identify the applicable tax rates in those locations.

- Nexus: Understand where you have a sales tax nexus, which can be physical (where your business operates) or economic (where you exceed a certain sales threshold). The regulations vary by location so use the official websites of tax authorities in the states or countries where you sell your SaaS product to identify your needs. This research is importantt part of how to expand your SaaS business into new countries successfully and compliantly. You may want to consult a tax professional.

- Tax Rates: Research the rates for sales tax within each jurisdiction in which you have nexus. These also vary, depending on the type of products/services and the location of your shoppers.

- Tax Exemptions: Some regions might have reduced rates or offer exemptions depending on your specific type of digital product. Investigate the exceptions carefully to be sure you are applying the proper rate.

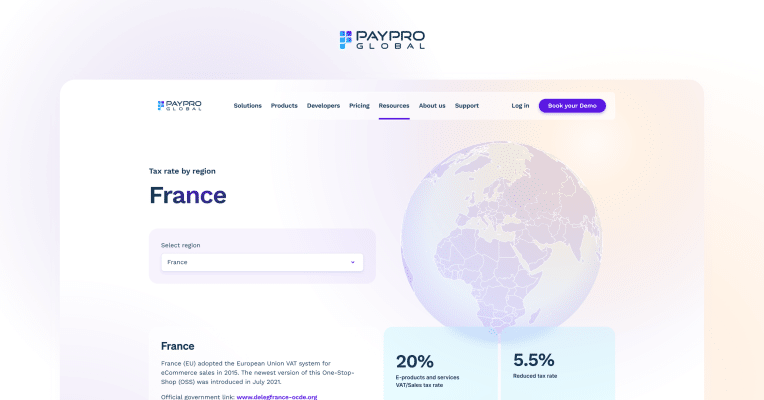

Check out this interactive map that displays details on percentages, thresholds, applicability and penalties within each area. We’ve designed it to help you save time and identify the different tax laws for your SaaS business.

Free SaaS Sales Tax Checklist

Download this checklist to navigate sales tax obligations with ease. Covers:

-

Nexus determination

-

Tax calculation

-

Filing procedures

-

and more!

Register for a Sales Tax Permit (US)

To determine which states you will need to collect sales tax and therefore register for a permit in each of those states, you’ll need to identify your nexus and applicable tax rates. Keep in mind, its illegal in most states to collect tax without this permit.

In order to obtain the tax permit, You’ll likely need to show the state’s authority on tax the following Business Information: Full legal name and address, FEIN… details typically established when you register your SaaS business.

- Business Information: Full legal name and address, FEIN (federal employer identification number) and contact details.

- Sales Information: Types of products/services, expected sales volume and an estimated of annual sales in their state.

- Banking Information: Bank account information to remit and collect sales tax.

Once you are registered, expect to receive your sales tax ID number. This will now be included on your tax returns and invoices. In addition, you’ll be assigned a filing frequency which dictates how often you will file and remit your state sales tax. In general, you can expect that the more you sell, the more often your frequency will be set.

Free SaaS Sales Tax Checklist

Download this checklist to navigate sales tax obligations with ease. Covers:

-

Nexus determination

-

Tax calculation

-

Filing procedures

-

and more!

Collect Sales Tax

After obtaining your permits and learning the applicable tax rates, you’ll need to enact a process for collecting tax from your shoppers. Implement a calculation tool for sales tax within your checkout process. This allows the correct tax to be calculated automatically by the shopper location. If you have any taxability that varies on products and services you sell, be certain you can customize tax rules derived on product categories and specific jurisdictions.

For B2B EU payments, it isn’t necessary to charge VAT, because there is a Reverse Charge mechanism that means the buyer will pay VAT to their government. In this case, you only need to request and validate a VAT ID from your business customer, as well as specify on the invoice that the transaction is subject to a reverse VAT charge. For additional guidance on B2B VAT, read this guide.

Make it clear on your checkout page and website if sales tax is included in the display price or if it will be added in the checkout process. Also show the itemization of sales tax on your invoices, including the tax rate, amount and jurisdiction. This is a key component of how to set up SaaS billing and recurring invoicing correctly to maintain transparency and compliance.

This will allow shoppers to know the total cost as well as your compliance and tax regulations.

Tax Absorption is a pricing alternative used in collecting sales tax in multiple regions. Choose this option to display your price at the same level for all countries and regions (globally). This marketing strategy is used to stimulate large-volume sales and gain market share by eliminating the confusion that varying VAT/sales tax rates causes and using a uniform price.

How to Implement: If you are a PayPro Global customer and want to activate the Absorb Tax option on PPG control panel – follow these instructions or simply reach out to us.

Free SaaS Sales Tax Checklist

Download this checklist to navigate sales tax obligations with ease. Covers:

-

Nexus determination

-

Tax calculation

-

Filing procedures

-

and more!

File and Remit

Since you’ve collected the sales tax from your shopper, you can now file and pay those taxes to the appropriate parties. To stay in compliance it is urgent that you handle this properly in order to avoid any unpleasant surprises.

→ Determine the filing schedule and due date for every country your customers are located in and each state in which you have nexus. Because they each have different filing dates you need to report the amount of sales tax you’ve collected from each state and country accordingly. This info is available on the relevant official tax authority websites.

Important: Don’t forget to set reminders and mark them on your calendar!

→ Prepare and file sales tax returns: Collect all the relevant info needed such as tax amount collected, eligible deductions, and sales data. This might not sound daunting, but it can be complicated if you are operating in multiple tax jurisdictions. Be sure to tally the tax amount collected across cities, states, countries and any other applicable jurisdictions.

→ Lastly, remit the sales taxes to the proper states! Keep in mind that each may have a different process for you to pay, such as online, check or bank transfer.

Important: Be sure to pay by the due date to avoid any fees or penalties.

Even with zero sales during the period of taxation, you still much file “zero returns”. You can expect to be fined from some states if this is not done.

To learn more about common sales tax mistakes in the SaaS industry and how to avoid them, check out this detailed article: Sales Tax Mistakes in SaaS.

Conclusion

Though handling SaaS sales tax may seem complex, it’s manageable with the proper approach. By understanding your tax responsibilities, implementing your strategy, and staying current on any changes will ensure you are compliant and avoid any costly issues.

PayPro Global is a MoR (merchant of record) that can simplify things for businesses. Those looking to scale and achieve global market expansion or startups with little expertise will find guidance in managing complex tax handling in every jurisdiction with the right partner.

PayPro Global takes on these complicated, labor intensive responsibilities like SaaS billing and sales tax, allowing you to focus on what you do best—creating and delivering exceptional SaaS products.

Have questions or need help? Don’t hesitate to reach out to PayPro Global’s team of experts. We’re here to help you navigate the intricacies of sales tax and achieve seamless compliance for your SaaS business.

FAQ

-

If you have physical or economic presence (nexus) where SaaS products are taxable, then you must collect tax. If your overall sales exceed a specific threshold, then economic nexus can be triggered so you must research the rules for each jurisdiction.

-

Once you have collected tax on your sales, filing your return with tax authorities should be completed, keeping in mind the method and frequency will vary by jurisdiction. You can partner with a MoR such as PayPro Global or use software to streamline the process.

-

When a seller takes on the cost of sales tax rather than making it the responsibility of the shopper, it is a strategy called tax absorption. By keeping the price the same for everyone globally, you can stimulate large volume sales, mitigate confusion with varying VAT/TAX rates and provide a universal price.

-

There are a few scenarios where you might not need to collect sales tax:

- No Nexus: If you don’t have nexus in a state, you’re not obligated to collect their sales tax.

- Exempt Products/Services: Some states exempt certain digital products or services from sales tax.

- B2B Transactions (EU): In the EU, the reverse charge mechanism shifts the VAT liability to the buyer in B2B transactions.

-

The penalties for not collecting sales tax vary by jurisdiction but can include fines, interest charges, and even criminal charges in some cases. It’s crucial to comply with sales tax laws to avoid these consequences.

-

An MoR (Merchant of Record) behaves as the legal seller, managing sales tax compliance, processing of payments and various other legal issues. By working with PayPro Global or a similar MOR who simplifies tax management, you’ll be able to focus on your product and be sure that you are in compliance.

-

Calculating sales tax rates: Tax Rate x Cost Of Item = Total Sales Tax.

Ready to get started?

We’ve been where you are. Let’s share our 18 years of experience and make your global dreams a reality.