Metriche e KPI SaaS

Che cos'è il tasso di crescita SaaS?

Qual è il tasso di crescita SaaS?

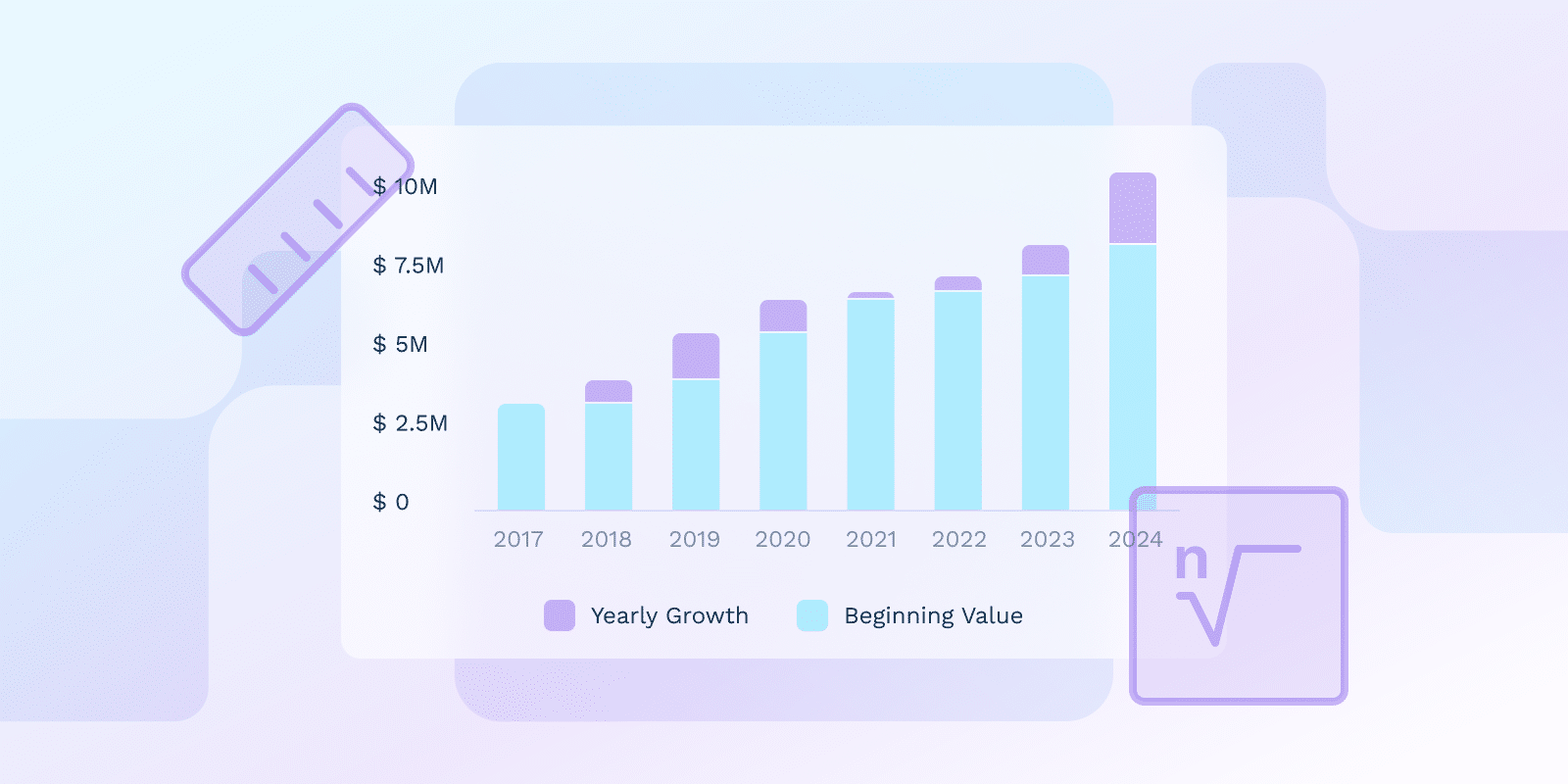

Il tasso di crescita è una metrica aziendale utilizzata dalle aziende SaaS per quantificare quanto una particolare variabile è aumentata o diminuita rispetto al suo valore di base. Il suo metodo di calcolo dipende dagli eventi considerati.

Come posso calcolare il tasso di crescita SaaS?

La formula per calcolare il tasso di crescita SaaS dipende dalla metrica che stai misurando. Ecco una ripartizione della formula generale e alcune metriche SaaS comuni:

Formula generale del tasso di crescita:

Tasso di crescita = [(Valore attuale - Valore precedente) / Valore precedente] * 100

Metriche SaaS comuni e le loro formule di tasso di crescita:

- Tasso di crescita del fatturato ricorrente mensile (MRR):

MRR rappresenta il reddito prevedibile e ricorrente degli abbonamenti mensili.

Tasso di crescita MRR = [(MRR del mese corrente - MRR del mese precedente) / MRR del mese precedente] * 100

- Tasso di crescita dei ricavi ricorrenti annuali (ARR):

ARR è il valore annualizzato del tuo MRR, che fornisce informazioni sulla salute a lungo termine della tua attività.

Tasso di crescita ARR = [(ARR dell'anno corrente - ARR dell'anno precedente) / ARR dell'anno precedente] * 100

- Tasso di abbandono dei clienti:

Il tasso di abbandono misura la percentuale di clienti che annullano i propri abbonamenti.

Tasso di abbandono = (Numero di clienti persi / Numero totale di clienti all'inizio del periodo) * 100

- Tasso di crescita del costo di acquisizione clienti (CAC):

CAC è il costo medio di acquisizione di un nuovo cliente.

Tasso di crescita del CAC = [(CAC del periodo corrente - CAC del periodo precedente) / CAC del periodo precedente] * 100

Quali sono i vantaggi del monitoraggio del tasso di crescita?

I tassi di crescita sono misure efficaci del benessere economico. I tassi di crescita sono misure efficaci del benessere economico. Forniscono un metodo per quantificare le alterazioni di una variabile economica su un lungo periodo, caratterizzato dalla sua relativa facilità di applicazione. I vantaggi includono:

- Comprensione delle tendenze: I tassi di crescita aiutano a comprendere i modelli mutevoli delle prestazioni economiche e a discernere cosa funziona e cosa no.

- Benchmarking: Consentono confronti intersettoriali e internazionali utili per il benchmarking e l'analisi della concorrenza.

- Attrattiva per gli investitori: Gli alti tassi di crescita sono attraenti per gli investitori.

- Identificazione delle aree di miglioramento: I tassi di crescita possono individuare aree specifiche dell'azienda che eccellono o che necessitano di attenzione.

Quali sono le principali differenze tra crescita semplice e composta?

La crescita semplice e composta illustrano due modi diversi di esprimere la crescita.

- Crescita semplice: Sebbene sia semplice da calcolare e comprendere, è applicabile a scenari finanziari a breve termine, avendo una portata limitata.

- Crescita composta: Questo è il processo di reinvestimento dei profitti, che potenzialmente genera ulteriori rendimenti, ma richiede una metodologia di calcolo più complessa.

| Caratteristica | Crescita semplice | Crescita composta |

|---|---|---|

| Aspetti di calcolo | ||

| Complessità di calcolo | Operazioni matematiche di base | Calcoli più complessi che coinvolgono funzioni esponenziali |

| Considerazione del tempo | Progressione lineare nel tempo | Progressione esponenziale nel tempo |

| Applicazione e utilizzo | ||

| Casi d'uso tipici | Scenari finanziari a breve termine | Analisi degli investimenti a lungo termine e pianificazione finanziaria |

| Applicazioni Aziendali | Confronti mese su mese | Analisi della crescita anno su anno (CAGR) |

| Impatto finanziario | ||

| Calcolo del rendimento | Basato solo sul valore iniziale | Basato sulla crescita accumulata |

| Potenziale di crescita | Limitato dalla progressione lineare | Maggiore potenziale grazie al reinvestimento dei rendimenti |

Cos'è un calcolatore del tasso di crescita?

Un calcolatore del tasso di crescita è uno strumento che utilizza quadri matematici e statistici per analizzare i dati e offrire proiezioni finanziarie. Questi strumenti sono pratici e rappresentano una risorsa aziendale nella previsione delle tendenze, purché il modello di calcolo e i dati utilizzati siano affidabili e accurati.

Cos'è il CAGR e come si collega alla crescita?

Il CAGR, o tasso di crescita annuale composto, è un tasso generalmente utilizzato per determinare il tasso di crescita annuale composto di un investimento in un periodo di tempo. Questo rapporto mostrerà un valore annuale costante. Questa è una metrica migliore delle medie aritmetiche di crescita.

Il CAGR è particolarmente utile quando si confronta la velocità di crescita di un investimento in un determinato periodo di tempo o quando si confrontano concorrenti simili nello stesso settore.

La formula utilizzata per calcolare il CAGR è: CAGR = [(Valore finale / Valore iniziale) ^ (1 / Numero di anni)] - 1

*dove:

Il valore finale rappresenta il valore finale dell'investimento. Il valore iniziale è il valore iniziale dell'investimento o della metrica. Il numero di anni rappresenta il periodo misurato.

Tieni presente che determinare il CAGR può essere un processo complesso se l'investimento in questione è soggetto alla volatilità del mercato.

Cos'è la crescita negativa nel SaaS?

La crescita negativa, nota anche come contrazione, si riferisce a una diminuzione dei ricavi in un determinato periodo. Questo periodo di contrazione può essere spiegato esaminando diversi fattori:

- Elevati tassi di abbandono: Quando il numero di clienti che annullano il loro Abbonamenti è superiore ai ricavi ottenuti dai clienti esistenti.

- Basso tasso di acquisizione: Quando un'azienda non riesce ad acquisire un numero elevato di nuovi clienti.

- Contrazione del mercato: Quando la domanda di un prodotto SaaS è bassa a causa della contrazione del mercato stesso.

Conclusione

Il tasso di crescita SaaS è una metrica essenziale per le aziende SaaS, che consente loro di comprendere i progressi aziendali attuali, nonché le tendenze del settore e le possibili opportunità di mercato.