SaaSの指標とKPI

バーンレートとは?

バーンレートとは?

バーンレートとは、損益分岐点に達する前または利益を上げて運営する前に、組織が財務を管理するスピードのことです。この指標は、まだ収益を上げておらず、コストを賄えていないスタートアップや新興企業に特に当てはまります。

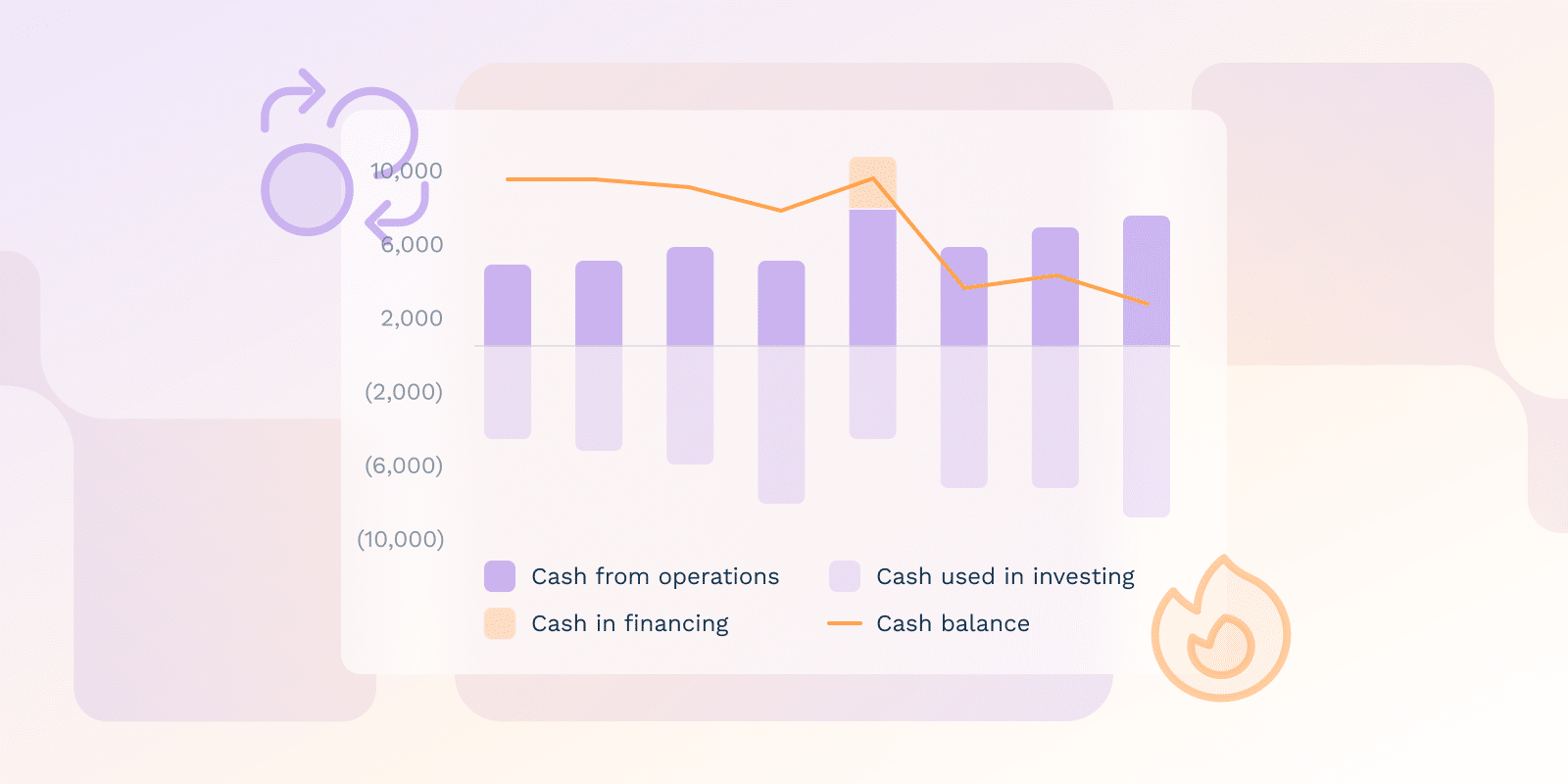

事業の現金準備金がどれくらい持つかを知っておくことは、キャッシュフローを適切に予測するために不可欠です。バーンレートは、会社の財務状況に関する洞察を明らかにすることがよくあります。高いバーンレートは潜在的な財務リスクを示唆する可能性がありますが、低いバーンレートは成長が限定されていることを示す可能性があります。

バーンレートの計算方法

バーンレートを計算するには、月などの期間の開始時と終了時の現金残高を確定します。

次に、期間の最終日の現金残高を取り、期間の最初の日の現金残高から差し引き、期間の月数で割ります。

会社が1か月を10万ドルで開始し、8万ドルで終了しなければならない場合を考えてみましょう。したがって、月間のバーンレートは20,000ドルで、これは(100,000ドル - 80,000ドル)/ 1か月 = 20,000ドルです。

バーンレートには2種類あることに注意してください。総バーンレートには特定の期間のすべての営業費用が含まれますが、純バーンレートはすべての営業費用を差し引いた後に発生します。

企業のバーンレートに影響を与える主な要因は何ですか?

バーンレートとは、組織が準備金を費やす期間またはレートであり、通常は支出率に応じて月または週で測定されます。次の要因を考慮してください。

- 事業を拡大する際には、企業規模、成長率、支出、収益源、キャッシュインフロー、その他の外部要因を考慮して、バーンレートを制御します。

- 収益の創出を検討します。収益の創出は、企業のリソースをどれだけ早く補充できるかを決定するためです。

- 一般的な管理費や、ローン返済などの資金調達のその他の影響は、全体的なバーンレートに関する計算に大きな影響を与えるため、見逃さないようにする必要があります。

- 過剰支出を管理することは、長期的な慎重な持続可能性を達成し、事業の進捗に対する潜在的な悪影響を軽減するために不可欠です。

バーンレートの重要性とは、投資家や利害関係者にとって何ですか?

バーンレートを監視することで、利害関係者は組織の財務状況、特に利用可能な現金資源の量に関する貴重な洞察を得ることができます。

事業への投資に伴うリスクの量と、現金の利用可能性に対する支出率を理解することで、バーンレートは事業をサポートするために利用可能なリソースを決定するのに役立ちます。

この指標により、組織が運営を継続し、到達できる期間が決定されます 損益分岐点 利益を得たり、追加の資金を受け取ったりせずに。

良いバーンレートとは何ですか?

バーンレートの計算には、マイナス成長と損失率の特定が含まれます。理想的なバーンレートは、組織が事業を継続せずに現金リソースをどれだけ早く枯渇させるかを明らかにします。

SaaS企業の場合、健全なバーンレートとは、加入者からの安定したキャッシュインフローがありながら、依然として顧客を獲得できる場合を指します。企業のプラスのキャッシュフローを示すマイナス純バーンレートは、投資家がその評価時に考慮する可能性のある財務指標です。 財務管理に影響を与えることができます。 とキャパシティ。

健全な財務管理を確保するために、経営陣は現金利用に対して慎重なアプローチを採用し、不要な資金調達を避ける必要があります。

| ビジネス段階 | 典型的なバーンレートの特徴 | 財務への影響 |

|---|---|---|

| スタートアップフェーズ | ||

| 初期段階のスタートアップ | 高いバーンレート、限られた収益 | 高額投資、キャッシュフローマイナス |

| シード/売上発生前 | 積極的な製品開発投資 | 投資家資金への依存 |

| 成長段階 | ||

| SaaSのスケーリング | 収益増加に伴う緩やかなバーンレート | 顧客獲得と資金確保のバランス |

| 確立されたSaaS | 安定した収益源と制御されたバーンレート | キャッシュフロープラス、持続可能な事業運営 |

| 成熟段階 | ||

| 成熟企業 | 低いバーンレート、予測可能な費用 | 強力な現金準備高、再投資の可能性 |

| マーケットリーダー | 最小限のバーンレート、多様な収益 | 戦略的支出、財務の柔軟性 |

企業はどのようにしてバーンレートを生産的に活用できるでしょうか?

組織によって発生したコストを追跡し、定期的に財務活動を説明します。支出を精査して、削減または改善すべき点を特定します。売掛金ファイナンスの実行、企業の運営予算を下回る支出、収益性の低い会社の支店の廃止など、収入を増やす方法を見つけます。

業務計画と 予測アプローチ バーンレート管理の簡素化に役立つ可能性がありますが、結果は異なる場合があります。

結論

バーンレートを測定すると、会社の財務状況とリスクに関する洞察が得られます。事業が現金準備金をどのくらいの速さで使用するかを測定するため、計画にとって重要です。この指標を見るときは、会社の規模、費用、収益、成長率を考慮してください。バーンレートを管理することは成功の保証ではありませんが、長寿と拡大の可能性を示しています。