How to Implement Cost-Plus Pricing to Your SaaS Business

To introduce the use of cost-plus pricing in a SaaS company, you need a clear, efficient strategy for calculating costs, and then adding a profit margin based on your objectives. This is important to ensure that the price covers expenses and generates a profit, reflecting the financial condition of the business.

This guide presents the process of creating and applying the cost-plus pricing model, which may be relevant in order to define a price for your product.

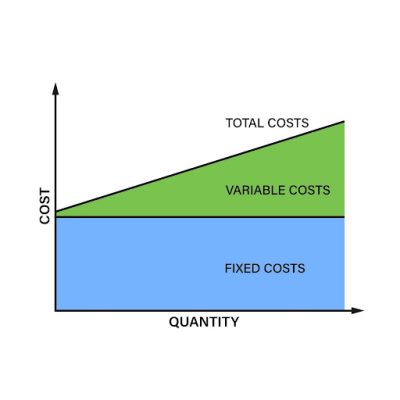

Calculate and Categorize the Total Costs for Your SaaS Product

The first step is to create a list of the costs associated with providing your software to individual users or units over a specific time period (e.g., monthly or yearly). This is the basis for the SaaS cost plus pricing strategie.

Then, inspect each activity of your SaaS product to identify and quantify every expense. Deploy costs to these categories:

|

Kostencategorie |

Description & Examples (SaaS Context) |

Cost Allocation Method |

|

Direct Costs (COGS) |

Expenses linked directly to the product/user provision. |

Divide the total cost by the number of users or transactions. |

|

Hosting & Infrastructure: AWS/Azure/GCP fees, database services, CDN. |

||

|

Direct Labor: Salaries for L1/L2 Customer Support, DevOps for maintenance. |

||

|

Third-Party APIs/Licenses: Cost of external tools required for the product’s core function (e.g., payment processing fees, SMS gateway costs). |

||

|

Amortized Development Costs |

Initial capital expenditures spread over the product’s expected useful life. |

Divide the total R&D cost by the expected user-months over 3-5 years (e.g., 36 months). |

|

R&D Salaries: Salaries of developers, product managers, and designers. |

||

|

Overhead Costs (Vaste kosten) |

Necessary costs that don’t change with production volume. |

Allocate a proportional share (e.g., based on headcount or revenue percentage) to the specific product/unit. |

|

Administrative Salaries: HR, Finance, Executive staff. |

||

|

Office Rent, Utilities, Insurance. |

||

|

Variabele kosten |

Costs that fluctuate with the volume of usage or sales. |

Directly track and calculate per unit or transaction. |

|

Sales Commissions. |

||

|

Marketing & Customer Acquisition Costs (CAC): While sometimes presented as a static overhead expense, the cost of customer acquisition should be taken into account in the cost of the unit as it determines the profitability. |

“CloudBoost” determines its per-user per-month costs like this:

- Direct Costs: The immediate expenses like Hosting, Customer Support, and Payment Fees come to $35.00.

- Amortized Development Costs: They took the initial $1 million R&D cost and spread it over 3 years, projecting 5,000 total users. This adds an average of $11.11 per user, per month.

- Allocated Overhead: that aren’t tied directly to the product, such as Rent and Admin Salaries, adding $8.89.

Adding up all these costs, the Total Cost per User/Month (TC) for CloudBoost is $55.00

Accurate Cost Allocation is the most significant challenge. In SaaS, costs are shared (e.g., a single server hosts multiple services). To provide an accurate view of the true unit cost you may use Activity-Based Costing (ABC)—where you assign costs to activities and then to products based on their use of those activities.

The Challenge of Effective Cost Management is to allocate costs properly, especially in SaaS, where costs are allocated multifunctional (for example, one server serves several services). To achieve an accurate representation of the true cost, the Activity-Based Costing (ABC) approach should be used, in which costs are allocated to activities and then to products based on the use of the activities.

Free Cost-Plus Based Pricing Strategy Checklist for SaaS

Learn how to calculate cost plus pricing, ensure profit, and validate your market position.

-

Step-by-step cost itemization

-

Profit margin setting guide

-

Competitive analysis cues

-

Review and adjustment triggers

Define and Formalize the Desired Profit Markup Percentage

Decide on the profit margin your company aims to achieve on top of the total costs. This margin is set as a markup percentage.

de profit margin your company aims to achieve on top of the total costs should be set as a markup percentage.

Define a specific markup percentage based on financial goals, market positioning, and stakeholder expectations.

A lower markup (e.g., 15-20%) may be an option if your company is a startup focused on rapid growth and market share. A higher range (e.g., 30-50%) may be a target for mature, profitable companies with strong defensibility. According to standard industry benchmarks, a gross margin of 70-80% (which directly relates to COGS) is targeted by many established B2B SaaS companies. However, for a total cost approach (which includes all overhead), a net profit margin of 20-30% is often targeted.

The formula to determine the markup percentage is:

| Markup Percentage = (Desired Profit / Total Cost) x 100 |

Take CloudBoost as an example. Its cost is $55.00 per unit. It seeks a 35% margin over cost, which could potentially fund software improvements.

Check your Customer Acquisition Cost (CAC) en Customer Lifetime Value (LTV). A cost plus pricing strategy should ensure that your LTV is significantly greater than your CAC. If your target markup (e.g., 20%) results in a price where LTV/CAC is less than the standard healthy ratio of 3:1, your markup is likely too low, or your CAC is too high.

Free Cost-Plus Based Pricing Strategy Checklist for SaaS

Learn how to calculate cost plus pricing, ensure profit, and validate your market position.

-

Step-by-step cost itemization

-

Profit margin setting guide

-

Competitive analysis cues

-

Review and adjustment triggers

Calculate the Selling Price using the Cost-Plus Pricing

Once you know the total cost, apply the desired profit percentage to it (the markup).

Use this simple Cost-Plus Pricing formula:

| Selling Price = Total Cost + (Total Cost x Markup Percentage) |

We will use the 35% profit goal (markup) with CloudBoost’s total cost:

- Total cost is $55

- Profit goal (35%) -> 0.35;

Let’s figure out the profit amount = $55.00 x 0.35 = $19.25

And now the selling price = $55.00 + $19.25 = $74.25

The final calculated price is $74.25 per user each month. This way they make sure that CloudBoost pays for all its costs and achieves its goal of a 35% profit.

If your SaaS company needs a reliable platform that can streamline and automate the facturering, Abonnementen, tax calculation & filings, payments processes globally, use PayPro Global’s all-in-one platform. It supports complex pricing models for SaaS businesses, including cost-plus, gestaffeld, en usage-based structures.

Free Cost-Plus Based Pricing Strategy Checklist for SaaS

Learn how to calculate cost plus pricing, ensure profit, and validate your market position.

-

Step-by-step cost itemization

-

Profit margin setting guide

-

Competitive analysis cues

-

Review and adjustment triggers

Validate the Calculated Price against Market Value and Competitor Pricing

The cost plus pricing strategy involves adding a profit margin to the cost of goods, making it an internal process. However, the market decides the actual price customers pay. This strategy integrates competitive and value-based approaches.

Perform a competitor analysis and a customer willingness-to-pay analysis:

|

Scenario |

Recommended Strategy |

Rationale |

|

New Market/High Differentiation |

Value-Based Pricing (Hybrid) |

Your value far exceeds your low SaaS cost base; pure cost-plus leaves money on the table. |

|

Commoditized/High Competition |

Concurrerende prijzen (Hybrid) |

Must align with competitors; cost-plus is a sanity check to ensure you don’t sell at a loss. |

|

Start-Up/Stable Costs/Funding Focus |

Cost-Plus (Initial) |

Easiest to justify to investors: “We cover all costs and make 20% profit.” Provides clear financial stability. |

|

Long-Term/Mature Product |

Value-Based + Cost-Plus (Hybrid) |

Use cost-plus to set the floor price, and value-based to set the ceiling price, maximizing revenue. |

If the calculated price of $74.25 is higher than what other competitors are offering for a similar product which is ~$65.00, you may consider doing the following: (a) lower your price (which means sacrificing profit), (b) increase the value of your product (moving towards value-based pricing) or (c) improve the efficiency of your marketing and sales efforts.

Tip: Gebruik Prijsstaffels to maximize profit: apply the cost plus pricing strategy to the baseline/lowest tier, and then apply Waardegebaseerde prijsstelling to the premium tiers, where the cost differential is minimal but the perceived customer value is high.

Free Cost-Plus Based Pricing Strategy Checklist for SaaS

Learn how to calculate cost plus pricing, ensure profit, and validate your market position.

-

Step-by-step cost itemization

-

Profit margin setting guide

-

Competitive analysis cues

-

Review and adjustment triggers

Implement a Systematic Review and Adjustment Cycle

SaaS costs often follow a non-linear pattern. As the customer base expands, the cost associated with each user may change significantly. If the pricing model is not flexible, it may not accurately capture the resulting economies of scale, it is necessary to establish a mandatory pricing review on a quarterly or semi-annual basis.

When to review your price? It’s important to check your prices right away when certain things happen. These are the main triggers that should make you review your pricing:

- If you notice a change in a key supplier’s costs, such as a variation greater than 10%

- When you reach an important user count (like going from 1,000 to 10,000 users) the per-user cost of service development and hosting can change;

- If a major competitor joins or leaves the market, or makes a significant change to their own pricing.

Tracking Metrics

Monitor your Gross Profit Margin en Net Profit Margin against the target you set in Step 2. If the net profit margin is consistently above 35%, it may be an opportunity to either increase the price (if you feel you are undercharging) or invest the extra profit into new features.

|

Maatstaf |

Target |

Action if Above Target |

Actie indien onder doel |

|

Net Profit Margin |

35% |

Maintain price/Increase R&D investment. |

Review costs (Step 1) or Increase Price/Markup (Step 3). |

|

LTV:CAC-ratio |

3:1 |

Increase Marketing Spend (Scale Growth). |

Review price (Is it too low?) or Reduce CAC. |

Conclusie

In conclusion, the cost plus pricing strategy provides a structure for recovering the costs associated with the SaaS product. The process involves calculating all the direct and indirect costs, adding a markup target, and then setting the selling price using the cost plus pricing formula. This method gives stability and a feeling of safety.

However, it should be reviewed periodically together with other strategic positions that are already in the market and are also responsive to the ever changing market.

Veelgestelde vragen

-

The formula is: Selling Price = Total Cost + (Total Cost × Markup Percentage). Ensure all operational expenses are covered to guarantee a specific profit margin on every sale.

-

The method primarily considers internal factors, which may relate to but not completely incorporate competitor pricing, market value perception, or customer payment thresholds.

Because software commonly involves significant initial investment and lower subsequent expenses, the application of cost-plus pricing alone may not provide a comprehensive valuation.

-

You must include all your expenses: things that change based on usage (like web hosting and support), fixed office costs (like rent and manager salaries), transaction fees, and a portion of the original development cost spread across each user.

Excluding fixed costs from pricing considerations may have implications for financial outcomes.

-

This method can be applied by new companies or those in markets with little competition and could affect their financial standing. It aims to facilitate covering expenses and achieving minimum profit goals in the initial stages.

Think of it as setting a floor price to help recover your initial investment before moving on to more complex pricing strategies based on the actual value of your software.

-

As the customer base grows, the Total Costs will decrease due to the effect of economies of scale. Your pricing strategy should be flexible enough to increase the profit margin or adjust the pricing model.

-

Yes, because there is a chance that the team will not focus on looking for cost-effective methods and will instead spend too much time on internal processes.

-

Cost-plus pricing helps determine if your price supports a healthy LTV:CAC ratio (ideally 3:1 or higher). The price must be high enough to cover CAC and COGS while providing sufficient LTV for sustainable growth.

Cost-plus pricing is useful in determining if your price covers all the costs, including CAC and COGS, and leaves a sufficient profit for growth. The price must be high enough to cover all expenses.

Klaar om te beginnen?

Wij zijn geweest waar u nu bent. Laten we onze 19 jaar ervaring delen en uw wereldwijde dromen werkelijkheid maken.