Financial Management

What are Tax Planning and Compliance in SaaS?

What are Tax Planning and Compliance?

Tax planning and compliance are two sides of your financial strategy. Planning involves knowing the rules of each state in order to avoid overpaying or underpaying tax and using it to make the most sensible financial decisions so your business can remain solvent.

Compliance means following the rules in the various areas in which your SaaS business operates and making financial decisions that ensure your business remains within the law. Choose an advisor with a thorough understanding of this area.

What counts as SaaS revenue?

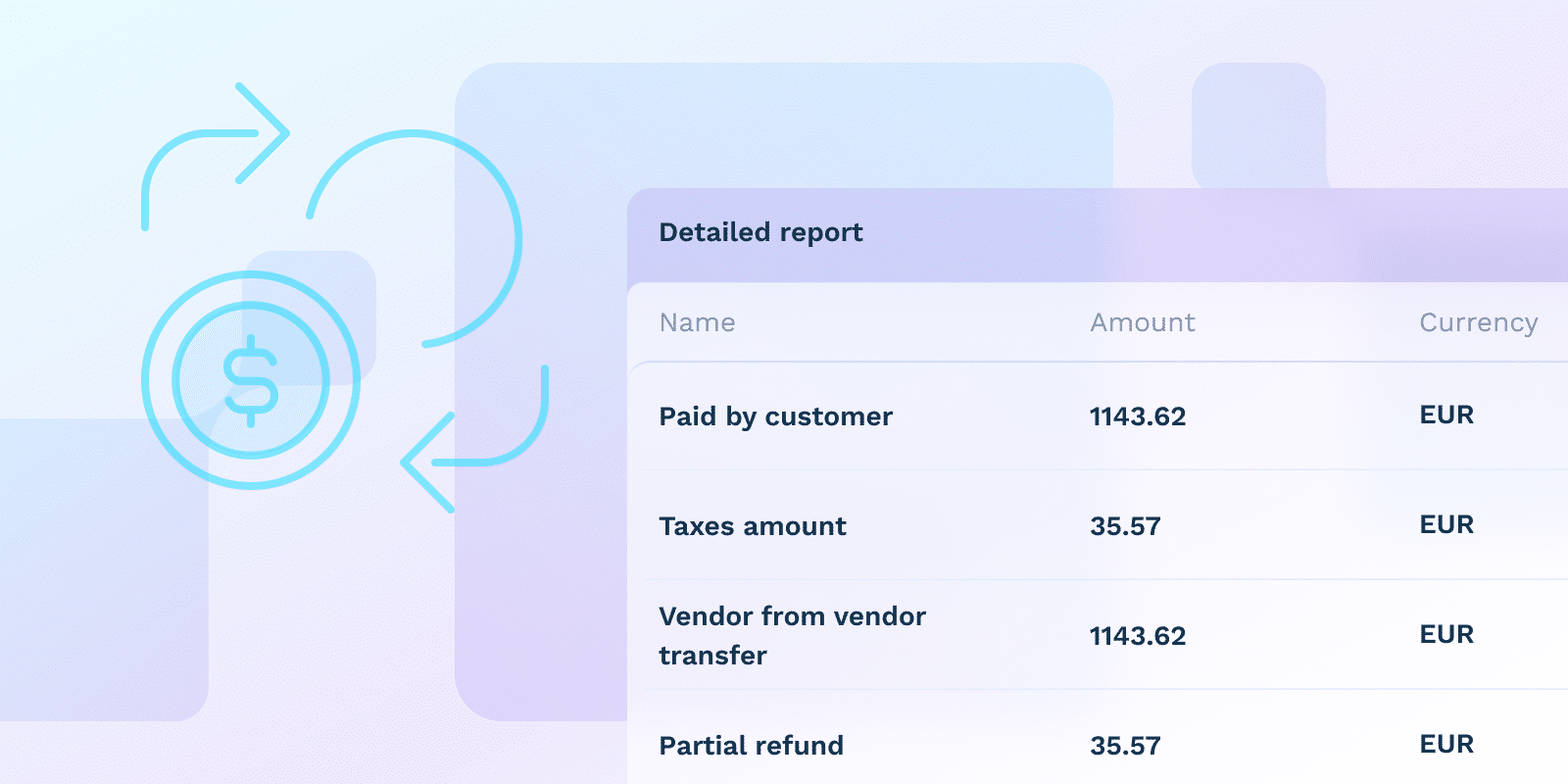

Governments require accurate tax reporting on SaaS revenue. Your financial reports must include things like subscription fees paid by each client, usage charges, and any income from additional services you provide.

Are SaaS transactions subject to sales tax?

Sales tax is a tax on goods that is levied at the point of sale to the end user. SaaS transactions in the US are subject to sales tax just like other consumer goods, although this differs across the various states. There are several states that do not require businesses to collect sales tax. Also, some states exempt certain types of SaaS products or offer specific tax breaks.

Check out our SaaS Sales Tax Guide to find out the correct tax amount applicable for SaaS and digital goods anywhere in the world.

Does SaaS create nexus?

Yes, it’s possible for SaaS businesses to create nexus.

Nexus is the presence of a business in any state, requiring your company to pay taxes local to that state. It might be a physical nexus such as a brick-and-mortar location (office or warehouse), or a nexus that involves passing a certain threshold of economic activity. This might be if your sales revenue exceeds a particular limit in a state.

Is SaaS taxable in the USA?

The USA usually requires SaaS businesses to pay tax but the laws and rules are different depending on factors like your client location, the kind of service you provide, and local tax laws. Sales tax is primarily a state-level issue in the USA.

| Taxation Aspect | Variation Details | Potential Impact on SaaS Businesses |

|---|---|---|

| Sales Tax Applicability | ||

| Tax Collection Requirement | Varies by state | Some states require sales tax collection, others do not |

| Product Exemptions | State-specific exemptions | Certain SaaS products may be tax-exempt in some states |

| Nexus Determination | ||

| Physical Nexus | Brick-and-mortar presence | Offices or warehouses trigger tax registration requirements |

| Economic Nexus | Sales revenue thresholds | Exceeding state-specific revenue limits requires tax compliance |

| Registration and Compliance | ||

| Registration Requirement | Per-state basis | Must register in states where nexus is established |

| Compliance Complexity | Highly variable | Requires continuous monitoring of changing state regulations |

Do SaaS companies need to register in every state?

If you establish a nexus in a particular state, then you need to register for tax and collect any required sales tax in every state where you have nexus.

Conclusion

US tax laws are particularly complex for SaaS businesses. This fact makes it particularly important that you equip yourself with knowledge about tax regulations, engage in financial planning, and comply with regulations both as they change and as your business grows. Pay particular attention to how compliance rules change across different states, and seek an advisor with specialist knowledge and advice.