Métricas e KPIs de SaaS

O que é Receita Recorrente Mensal Comprometida (CMRR)?

Published: outubro 18, 2024

Last updated: novembro 26, 2024

O que é CMRR (receita recorrente mensal comprometida)?

CMRR mostra as despesas das organizações em relação a investimentos, disponibilidade de recursos e cotas de pessoal. Em contraste, a receita por meio de assinaturas leva em consideração apenas as reservas e a rotatividade.

Utilizando CMRR em um ambiente SaaS, as empresas podem estimar seus ganhos futuros com base em seus compromissos contratuais de receita recorrente.

Tenha em mente: CMRR é um relatório para o futuro, portanto, não coincide com as receitas reais recebidas.

Qual é a diferença entre CMRR e MRR?

CMRR e MRR são indicadores de desempenho para negócios SaaS.

MRR (Receita Recorrente Mensal) é a receita acumulada de assinaturas ativas nos últimos 30 dias, enquanto CMRR visualiza o futuro.

A fórmula de CMRR inclui MRR e antecipa vários resultados possíveis, incluindo rotatividade de assinantes, ajustes de plano e alterações em planos pagos, fornecendo uma perspectiva abrangente.

O cancelamento antecipado de assinantes fortalece o CMRR, pois faz mais sentido para a capacidade operacional do que o MRR, que tem uma visão limitada.

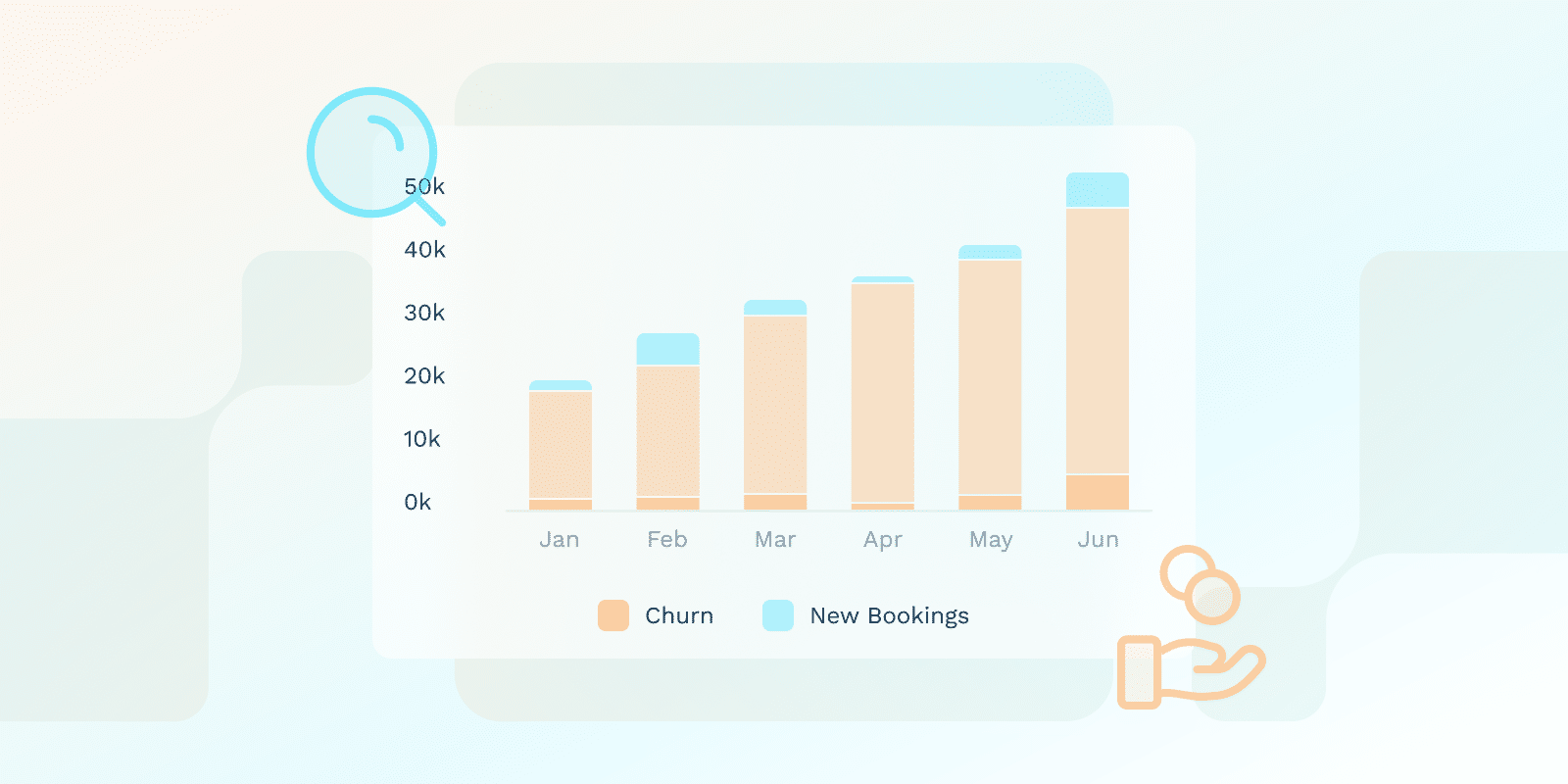

A fórmula para calcular o CMRR é: CMRR final = CMRR inicial + CMRR de novas reservas + CMRR de expansão - CMRR cancelado.

Quais são os principais benefícios de usar o CMRR?

Coletar dados sobre CMRR (Receita Recorrente Mensal Comprometida) pode ser relevante para tomar decisões estratégicas sobre crescimento e investimento.

Previsão de receita fornece insights para alocação estratégica de orçamento e distribuição de recursos com base nas necessidades futuras previstas.

CMRR é particularmente relevante para empresas recorrentes baseadas em assinatura, pois prevê receita recorrente e desempenho financeiro geral. Ele também:

- A previsão da receita recorrente mensal (MRR) é refinada considerando contrações e upsells prospectivos.

- Oferece uma análise completa dos fluxos de caixa totais esperados, incluindo fluxos de caixa de novos futuros aquisições de clientes e a possível perda de alguns clientes.

- Enfrente a rotatividade de clientes por meio da previsão antecipada de rotatividade potencial.

- Retrata ênfase na reserva de novos negócios, pois a rotatividade pode ser confundida com empresas que têm ciclos de venda mais curtos.

Como as empresas podem aumentar o CMRR?

As empresas podem potencialmente influenciar o CMRR por meio de estratégias para melhorar Retenção de clientes, potencialmente mitigando perdas de clientes e promovendo upsells. É essencial identificar os impulsionadores da CMRR identificando rotatividade, atualizações ou rebaixamentos e melhorando os serviços de assinatura.

Em termos de receita de contrato mensal reservada e alterações de contrato planejadas, o CMRR também foi alterado, portanto, a melhoria nessa direção também maximizará o CMRR.

As empresas devem implementar medidas para melhorar a retenção de clientes incorporando a rotatividade esperada nos cálculos de CMRR.

O que é considerado um bom CMRR para uma empresa com modelo SaaS?

Para uma empresa de SaaS, um bom CMRR demonstra crescimento e estabilidade. Embora não haja um número mágico que se aplique a todas as situações, ao relatar o CMRR, um ganho líquido em assinaturas e um CMRR crescente são típicos.

Tenha em mente que a relação entre o CMRR e os resultados de crescimento de uma empresa de SaaS pode ser influenciada por vários fatores, incluindo um CMRR favorável.

- Um CMRR é uma métrica valiosa para empresas de SaaS que buscam levantar fundos e obter investidores, pois reflete a capacidade da empresa de gerar receita de forma eficaz e cobrir seus custos.

- Um CMRR alto indica uma probabilidade de uma empresa de SaaS garantir futuras oportunidades de negócios, embora outros fatores possam influenciar o resultado.

- A relação entre mitigação de rotatividade e crescimento de mercado é complexa, e a rotatividade reduzida pode ser um fator contribuinte que pode influenciar a expansão do mercado.

- Embora um CMRR alto seja frequentemente associado a um ambiente de captação de recursos mais favorável, um CMRR baixo não desqualifica automaticamente uma empresa de SaaS de garantir financiamento.

Qual método as empresas usam para rastrear dados de CMRR?

A lógica de rastreamento de dados de CMRR considera o MRR real para um período mensal, além das reservas cumulativas atuais e dados de rotatividade. Este método envolve registrar todos os pedidos irregulares de reserva, alterações de contratos mostradas em cronogramas e planejar a receita todos os meses.

Em qualquer organização, o gerenciamento e o cálculo do CMRR devem envolver o uso de várias ferramentas e softwares automatizados que impulsionam o rastreamento eficaz.

As principais métricas no modelo SaaS são MRR, reservas, cancelamentos e despesas de downgrade, todas as quais podem ser monitoradas em tempo real para calcular o CMRR. Como uma assinatura não é estagnada, os sistemas que monitoram o CMRR também devem ser flexíveis o suficiente para ajudar a capturar o CMRR com precisão.

Conclusão

A Receita Recorrente Mensal Comprometida (CMRR) é uma métrica crucial para empresas SaaS, fornecendo uma imagem mais precisa dos ganhos futuros do que a MRR ao levar em consideração a rotatividade, ajustes de plano e alterações em planos pagos.

O uso do CMRR pode informar a tomada de decisão estratégica e a alocação de recursos para empresas SaaS, fornecendo projeções de receita potencial, fluxo de caixa e rotatividade.

As empresas SaaS usam o CMRR para analisar suas operações, relacionamentos com clientes e estrutura de financiamento para identificar áreas relacionadas à obtenção de crescimento sustentável.